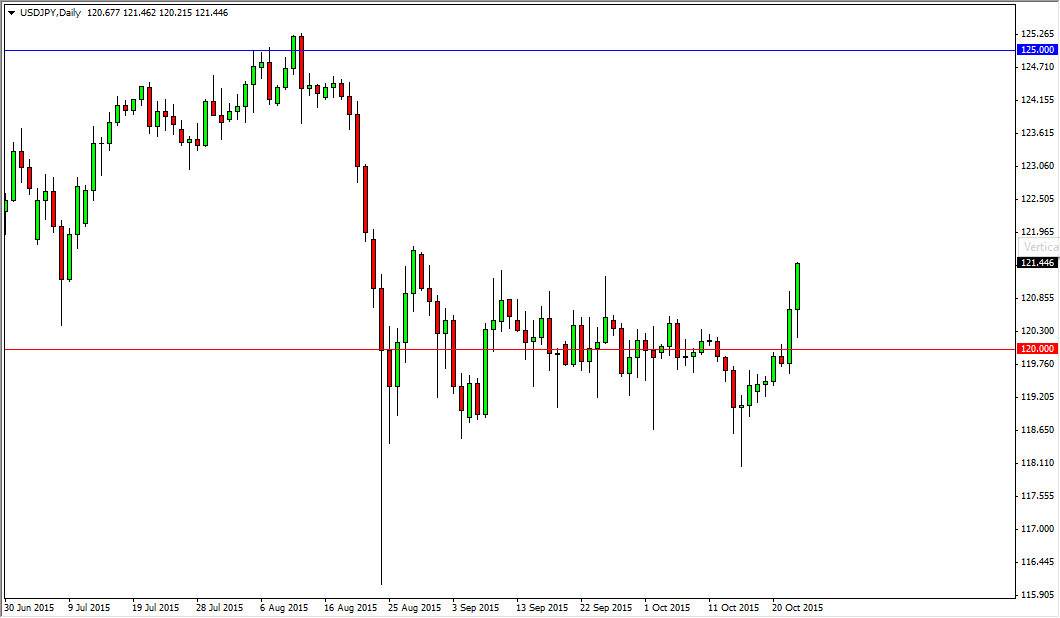

The USD/JPY pair pulled back initially during the course of the session on Friday, but found enough support to turn the market back around and reach towards the 121.50 level. Ultimately, if we can break above the top of that candle, the market should then reach towards the 125 level given enough time. Quite frankly, this is a pair that I think will continue to strengthen due to be European Central Bank and its actions recently. When they suggested that the ECB was ready to add more stimulus, the reality is that the Euro will fall against the value the US dollar, which has a knock on effect of the US dollar strengthening against almost everything else. With that being the case, it makes sense if this continues. Also, you have to keep in mind that the Bank of Japan has a monetary policy statement coming out later this week that could certainly move this market going forward.

Bank of Japan to soften stance?

The Bank of Japan could very well add more stimulus to the marketplace as the central bank is known for doing so. With this, you will have to pay attention to those announcements and of course comments, but at that point time I feel that this market would then swerve to the 125 handle over the course of the next couple of sessions. I don’t really have an interest in selling this pair, because I think there is massive support all the way down to the 118.50 level. That area there should be a massive buying opportunity if we get a supportive candle, so at this point in time I look at that as a gift, not anything to be concerned about.

Ultimately though, I believe that we not only reach the 125 level, but someday will break out and go much higher than that. In the meantime, you will have to play short-term charts or at least recognize that volatility will be the way going forward.