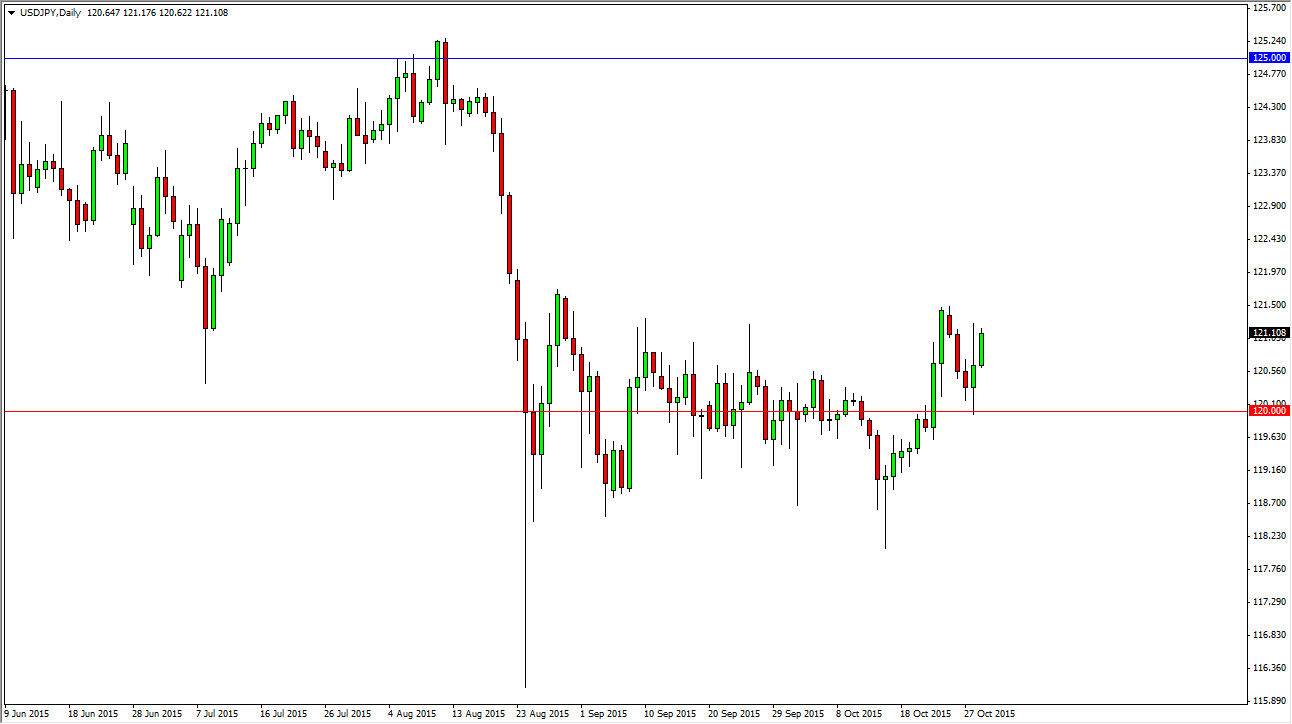

The USD/JPY pair broke higher during the session again on Thursday, as we regained all the area that we pulled back from during the rally on Wednesday. Because of this, the market looks as if it is going to go higher, and perhaps challenge the 121.50 level. With that being the case, the market looks as if it is ready to break out, and that of course would be a longer-term “buy-and-hold” type of signal. At that point in time I would anticipate this market heading to the 125 handle, albeit over several weeks if not months. I do not expect a massive move in one direction or the other unless of course the Bank of Japan gets directly involved which they have been known to do.

Quantitative easing

The Bank of Japan may enter more quantitative easing, and if that’s the case it could accelerate the upside to this pair. I believe that pullbacks at this point in time will find plenty of support at the 120 handle, and most certainly at the 118.50 level. We have seen a nice bounce recently over the last couple of weeks, and I believe this shows that there is more than enough buying pressure below to keep this market at the very least afloat. I believe that we go higher than 125 given enough time though, so quite frankly this point in time I am ignoring any sell signals, although they will appear from time to time.

I believe that once we break out above 121.50, the market will be best played by going long via short-term dips. The short-term dips should continue to offer value that we can take advantage of over the longer term. In fact, a lot of traders will be adding small positions on in a bit of pyramiding as it can allow for massive positions to be built up. I think that’s probably the way to go if you have that ability.