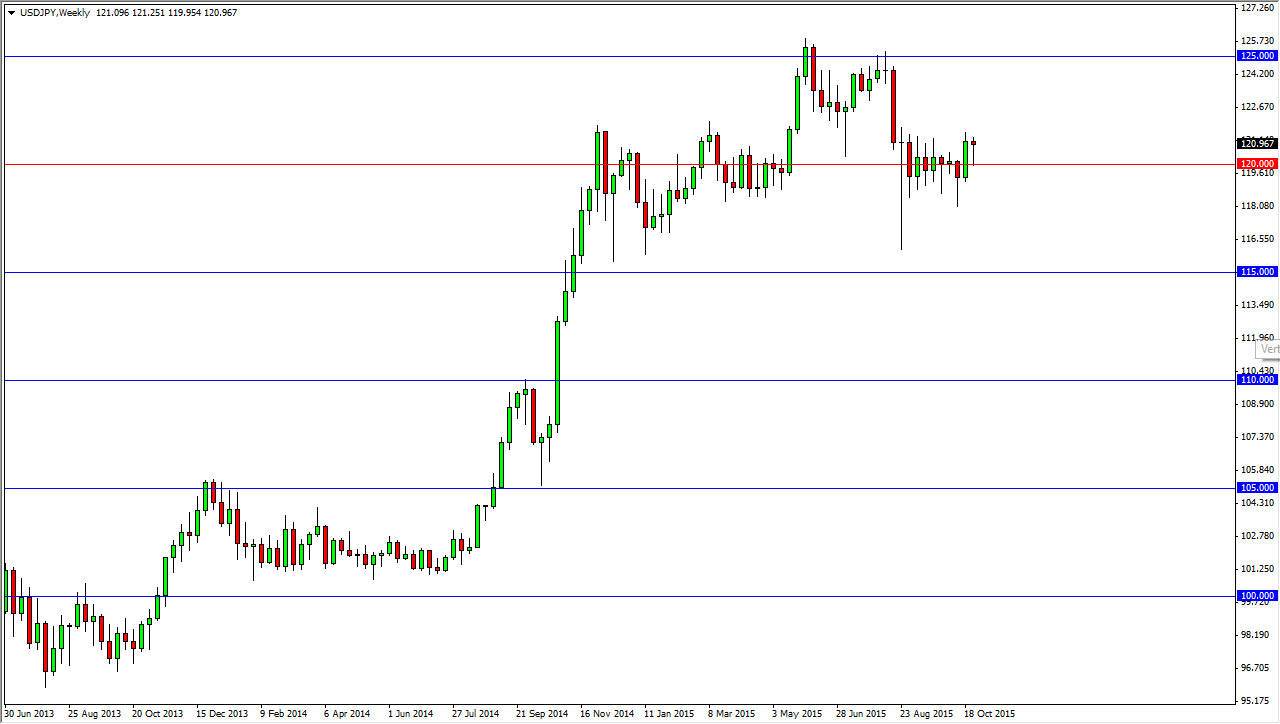

The USD/JPY pair did almost nothing during the month of October, as we continue to be attracted to the 120 handle. Further compounding the problems in this pair is the fact that the Federal Reserve didn’t have the wherewithal to raise interest rates. In fact, they now have suggested that it might be quite a while before that happens. On the other side of the coin, the European Central Bank is also suggested the same thing, while we all know that the Bank of Japan will remain easy as far as monetary policy is concerned as well. In other words, we are still very much in the currency war, so it will cause the Forex markets to struggle for longer-term clarity.

This pair tends to be very sensitive to the risk appetite of traders around the world, going higher as they feel more comfortable to take risk on. With this, it’s more than likely going to be choppy but at the same time with the central banks around the world forcing money into risk assets, we will more than likely go higher in this pair.

125, my longer-term target

The 125 level above has been my longer-term target for some time now, and I still think that’s where we're going. If we can get above the 121.50 level, I feel the market will then make a move towards that level. The 118.50 level below is massively supportive, as it has been the bottom of the consolidation area that the market has been working with recently. If we break down below there, things could get very ugly, but quite frankly I feel that’s the least likely thing to happen at this point in time.

On a move above the aforementioned 121.50 level, expect a lot of volatility only way up to the 125 handle, so think of any long position as more or less an investment if you are trying to hang onto the trade. On the other hand, you could buy this market on short-term pullbacks and show signs of support.