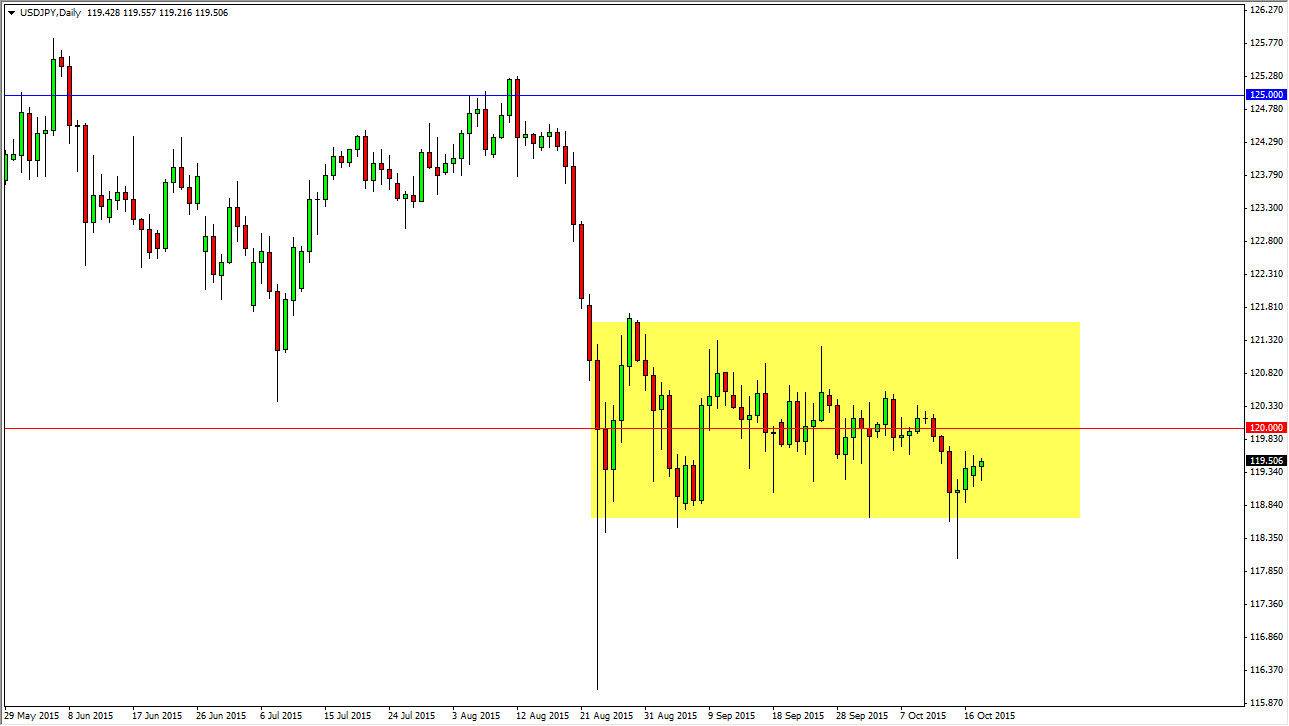

The USD/JPY pair initially fell during the day on Monday, but did bounce by the time it was all said and done. This is a market that continues to show stubborn support, even after we broke to fairly significant lows during last week. We actually tested the 118 level, which of course was a bit of surprise. We formed a hammer during that session on Thursday, and now it appears that we are going to grind our way higher.

Looking at this chart, it’s easy to see that there is a consolidation area that is essentially centered out the 120 handle. I think that will be the way going forward, because quite frankly the central banks involved in this pair are both very dovish. The fact that the Federal Reserve could not raise interest rates was a bit of a shock to the marketplace, and with that people are starting to reassess interest-rate expectations.

The battle of two soft banks

I believe that this market is essentially focusing on the fact that the Federal Reserve doesn’t know what it’s doing, let alone what it can do. On the other side of the Pacific Ocean you have the Bank of Japan, which naturally will be very easy as far as monetary policy is concerned. They have been one of the easiest central banks around the world for years, and although the Federal Reserve is very easy itself, the truth of the matter is that sooner or later the Americans will have to raise interest rates. The Japanese on the other hand have shown that they can go decades without raising interest rates and certainly will do so. There’s absolutely no inflationary concerns in Japan, while there are some signs of potential inflation coming into the situation in America. Granted, we are not necessarily near the interest-rate hike in America, but we are much closer than we are in Japan, and then essentially will push this market higher. In the short-term, I’m just playing this for a short-term bounce to the 121 area.