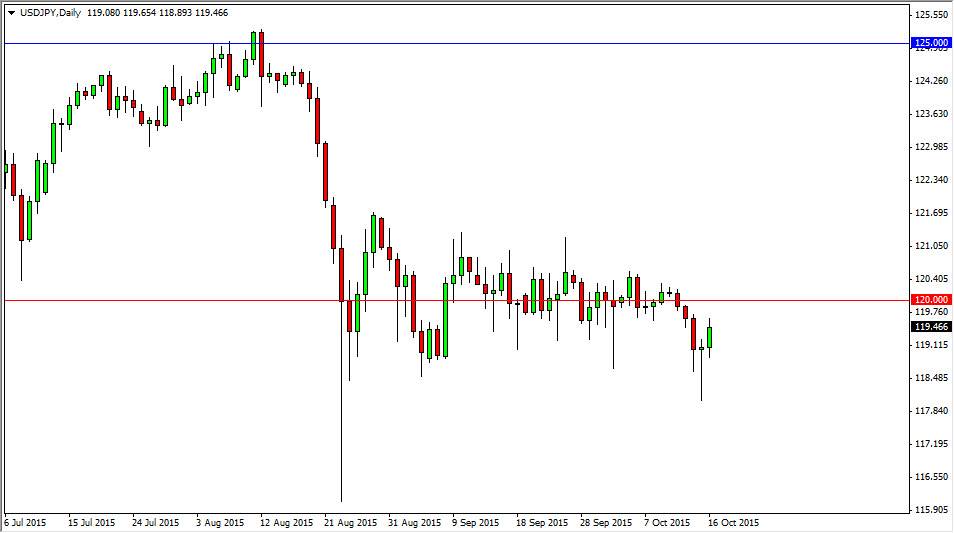

The USD/JPY pair broke higher during the course of the day on Friday, clearing the top of the hammer from the Thursday candle. That being the case, the market looks as if it is ready to continue the previous consolidation area that we have seen for some time. Granted, the US dollar is in a bit of trouble, but we also have the Bank of Japan on the other side of the equation here, and they will not hesitate to step into this marketplace and try to weaken the value of the Japanese yen through quantitative easing or flat out manipulation.

I believe that this market will reach back towards the 121 handle, which of course was the top of the recent consolidation. I think that the market will eventually break above there, and once it does it should reach towards the 125 handle.

Longer-term bullishness?

Although the US dollar is selling off against many other currencies around the world, quite frankly it is quite common for this pair to go higher while the EUR/USD does as well. This pair tends to move a little bit in a counterintuitive mode, and as stocks and risk appetite should continue to go higher. That being the case, I think that the buyers will come back into this marketplace every time it pulls back.

If and when we can break above the 121 handle, I feel that the market is going to reach towards the 125 handle after that. Ultimately, I think that area will be massively resistive, but at the moment it seems like the market is simply trying to grind its way sideways and build up enough momentum to go higher. It’s a difficult thing to do when there so much negativity around the US dollar, but eventually it will happen.

It’s not until we break below the bottom of the hammer that formed on Thursday that I would be concerned about the consolidation, but at that point in time I have no interest in selling either. I know it would be very negative, but quite frankly I feel a lot of the other currency pairs will move much quicker against the US dollar in that scenario.