USD/CHF Signal Update

Yesterday’s signals were not triggered and expired as there was no bearish price action when the price reached 0.9900.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Long Trade 1

Go long after bullish price action on the H1 time frame following a touch of 0.9870.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long after bullish price action on the H1 time frame following a touch of 0.9800.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.0000.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

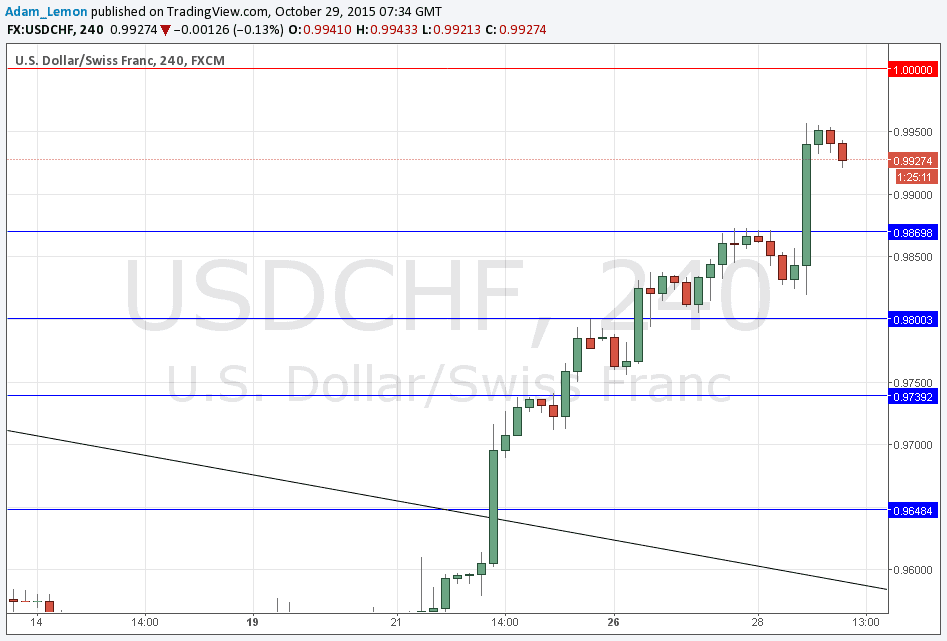

USD/CHF Analysis

I wrote yesterday that a USD-positive FOMC later today would make this the logical pair to be long of. This turned out to be the case as the bullish FOMC release pushed the price up by more than 1.25% within minutes, and the pair reached a new multi-month high. The price has been falling off overnight, but we can expect new support at the earlier swing high of 0.9870 and of course the round number at 0.9800. I am less sure about 0.9900.

There are no good flipped levels above anywhere nearby, but the huge round number at 1.0000 is quite likely to be resistant to some degree.

Regarding the USD, there will be a release of Advance GDP and Unemployment Claims at 12:30pm London time. There is nothing due concerning the CHF.