USD/CHF Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken between 8am and 5pm London time today only.

Long Trade 1

Long entry after bullish price action on the H1 time frame following a touch of 0.9550.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Long entry after bullish price action on the H1 time frame following a touch of 0.9500.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.9648.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

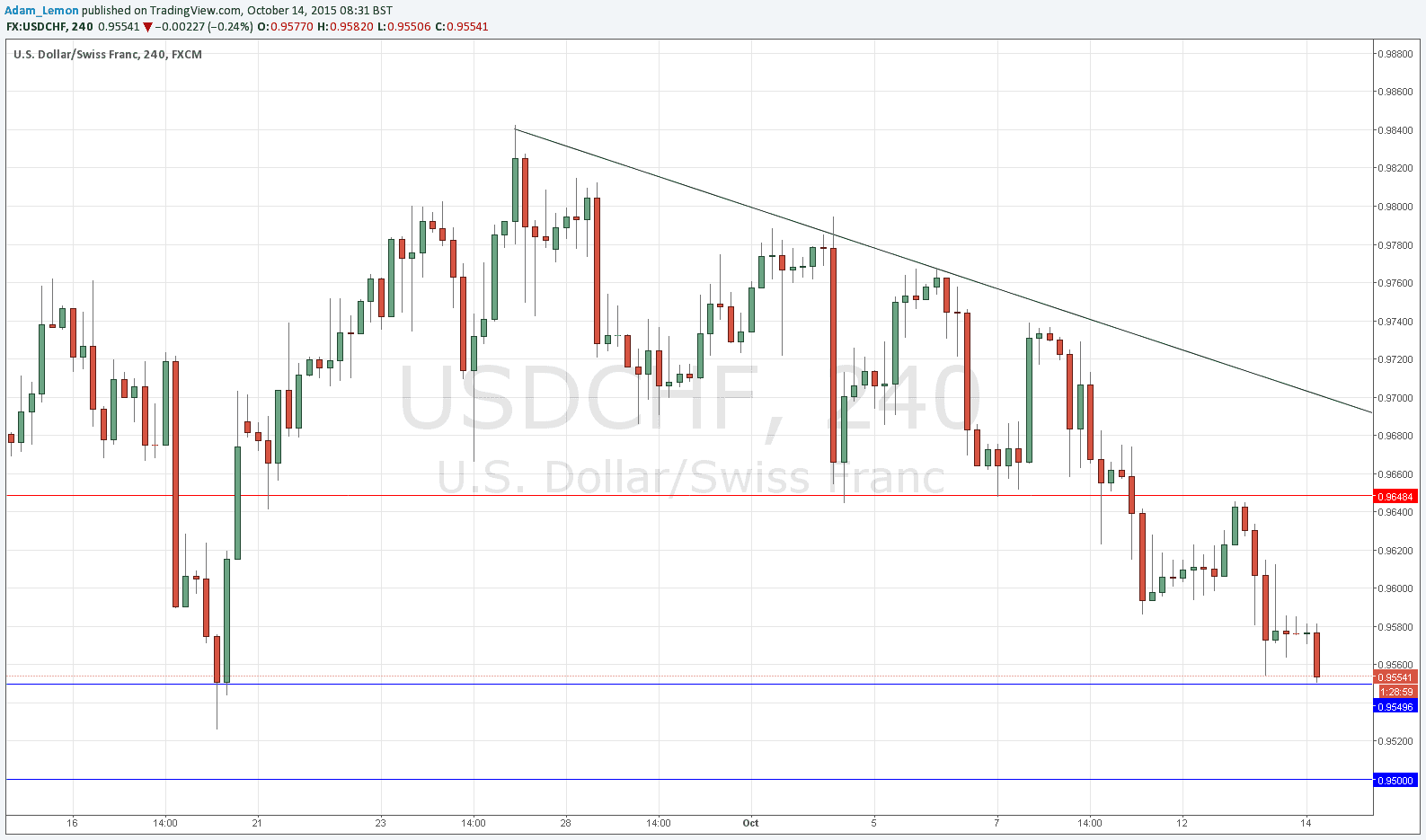

USD/CHF Analysis

Yesterday I forecast that “action over the medium-term looks bearish and suggests that the next stop is going to be the support at 0.9550”. This is exactly where we are at the time of writing: sitting on 0.9550. It is too early to say whether we are going to break down below this level, or whether the price will now turn around and rise back up towards 0.9650. It currently looks like we are going to get a break down and the action above looks bearish so even a bullish reversal might be short-lived and not go very far. It may well depend upon the USD news that will be coming out at around the New York open later.

If the price does break down, we can expect 0.9500 to be very good support.

There are no high-impact releases due today concerning the CHF. Regarding the USD, there will be releases of Retail Sales and PPI data at 1:30pm London time.