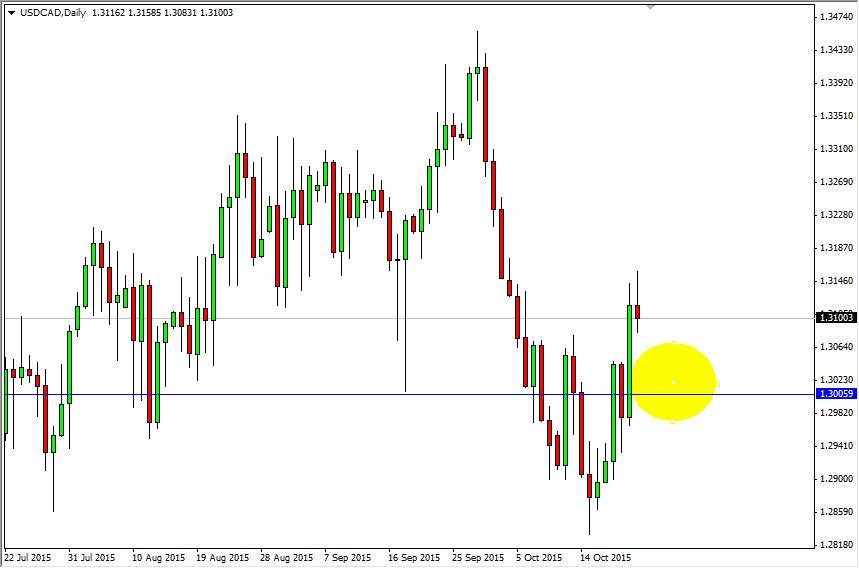

During the session on Thursday, the USD/CAD pair initially tried to rally but found the area near the 1.3150 level to be far too resistive. Because of this, we ended up falling and forming a shooting star. That being the case, the market will more than likely fall from here and look for support below. We have broken out above significant resistance, so I think that this is a simple “breakout, pullback, test for support” type of move. This happens time and time again, and therefore I am not willing to sell this market quite yet as I think the buyers will be interested in taking advantage of what has been an obvious breakout.

The yellow circle on the chart represents the area that I think the buyers will be enticed to buying, and as a result I am simply going to let the market fall back towards me in order to start going long. On the other hand, if we break above the top of the shooting star, that’s a very bullish sign as well and I would not hesitate to start buying there either.

The role of crude oil

Keep in mind that crude oil has a significant amount of influence on the Canadian dollar, and as a result you have to keep an eye on the WTI Crude Oil market. The Canadians export quite a bit of crude oil, and that of course is one of the major reasons why they are so tied to the value of that market. Ultimately though, the correlation isn’t as strong as it once was. After all, the Americans are starting to provide quite a bit of their own crude oil. However, there is still that correlation, so as oil goes higher, the CAD increases in value and vice versa. The market should see a lot of support below though, and as a result I am a buyer of supportive candles after pullbacks.