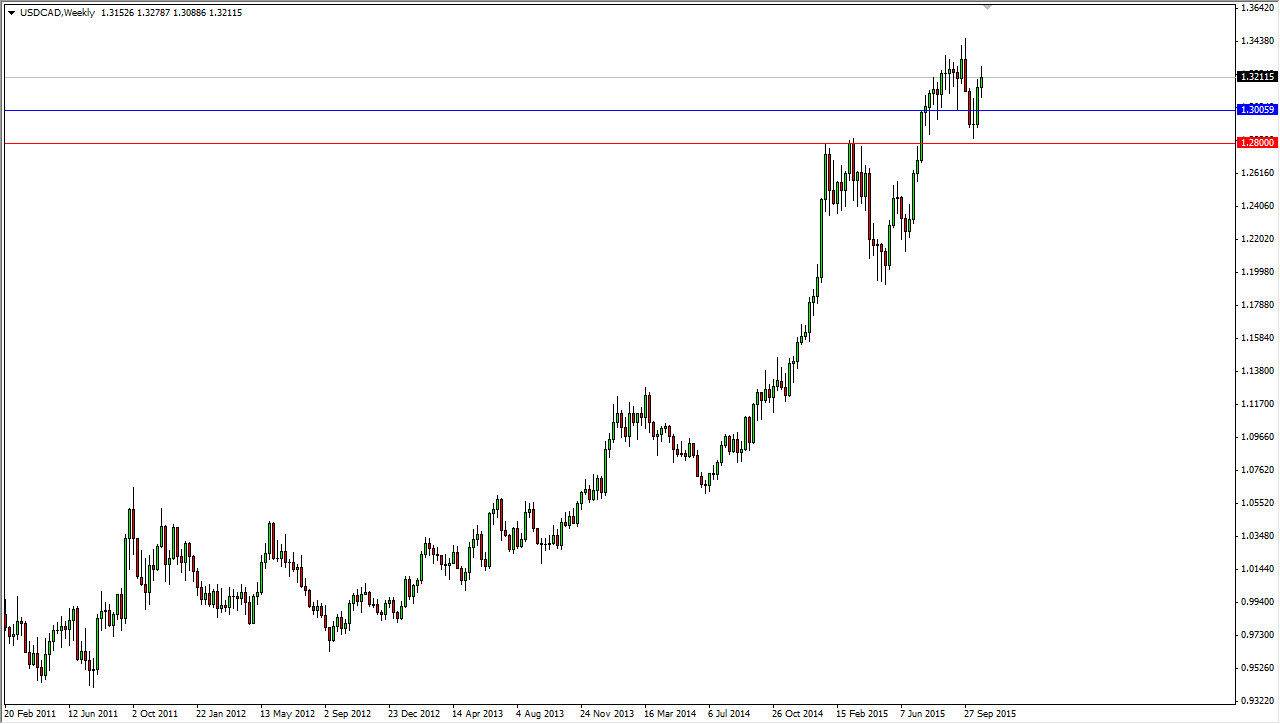

The USD/CAD pair has had a relatively volatile October, reaching all the way down towards the 1.28 handle. With this, it appears that the market has pulled back just a bit in order to find support. The support at 1.28 was previously very resistive, so having said that it’s likely that it should hold and that we should continue to go higher. On top of that, I believe that there is going to be a bit of a “risk off” attitude when it comes to currency markets.

I don’t like the Canadian dollar at the moment, and I believe that the break above the 1.30 level a while back was a sign that we were going to go much higher. It was an area that had caused massive resistance during the financial crisis, and breaking above there was indeed a very significant sign of strength. At this point in time, I think that this pair will continue to be very volatile, but ultimately should go much higher given enough time.

Oil

Don’t forget that oil has a bit of a say in this market as well, but the reality is that the Americans get more of their own oil these days, so that component will be as influential in the USD/CAD pair as it could be in other places such as the CAD/JPY pair, or perhaps the EUR/CAD pair. Because of this, the market looks as if the real play in the Canadian dollar will depend on oil in the sense that a strengthening Canadian dollar begs for trading and other currency pairs such as the ones mentioned previously, but a softening oil market says that you should be involved in this market specifically. It’s not to say that this market will go higher either way, I think it will, but at the end of the day you have to look for some type of catalyst.

One of the determining factors in whether or not we go higher faster will be the oil market. While I believe that oil markets can hurt the Canadian dollar, I do not expect the Canadian dollar to strengthen massively against the US dollar, even if oil rises. This is a one-way trade of sorts, at least as long as we stay above the 1.28 handle.