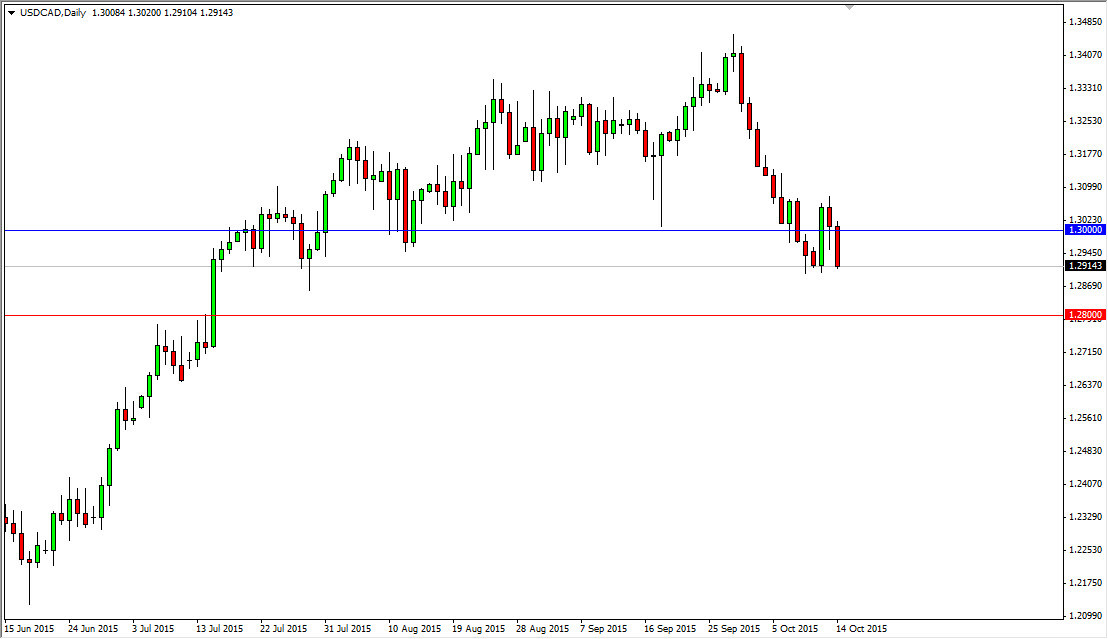

The USD/CAD pair fell during the course of the session on Wednesday, as we have seen time and time again over the last couple of weeks. However, the reality is that there is a significant support zone in this pair that is going to be difficult to break down. I think that the market has massive support between the 1.30 level on the time, and the 1.28 level on the bottom. Ultimately, if we can break down below there things could get rather ugly, as the area represents a “line in the sand” for the buyers as far as I can see. After all, it was this area the kept the market down previously during the financial crisis that of course was so volatile. Ultimately, I do believe that a break down below there would be catastrophic and probably shown the “beginning of the end” of the uptrend in the US dollar. I believe that to be true not only in this pair, but in many other pairs.

Broad dollar weakness

At this moment, it appears that the US dollar is losing strength against most currencies, and as a result I feel that a break down in this pair is more likely than ever. Ultimately though, if we get a bounce from here, we could see a significant move higher. If we can break above the top of the hammer from the Tuesday session that would be a very bullish sign and it should send this market looking for the 1.34 handle. Ultimately, the market would need a little bit of help from the US dollar overall, and as a result I am a bit cautious about going long.

One of the market you may want to pay attention to is the EUR/USD pair. If we can break significantly above the 1.15 level, I feel this pair will eventually break down. Also, pay attention to the oil markets, because they of course have an influence on the Canadian dollar as well. If oil takes off to the upside, and I might be just enough to push this pair lower.