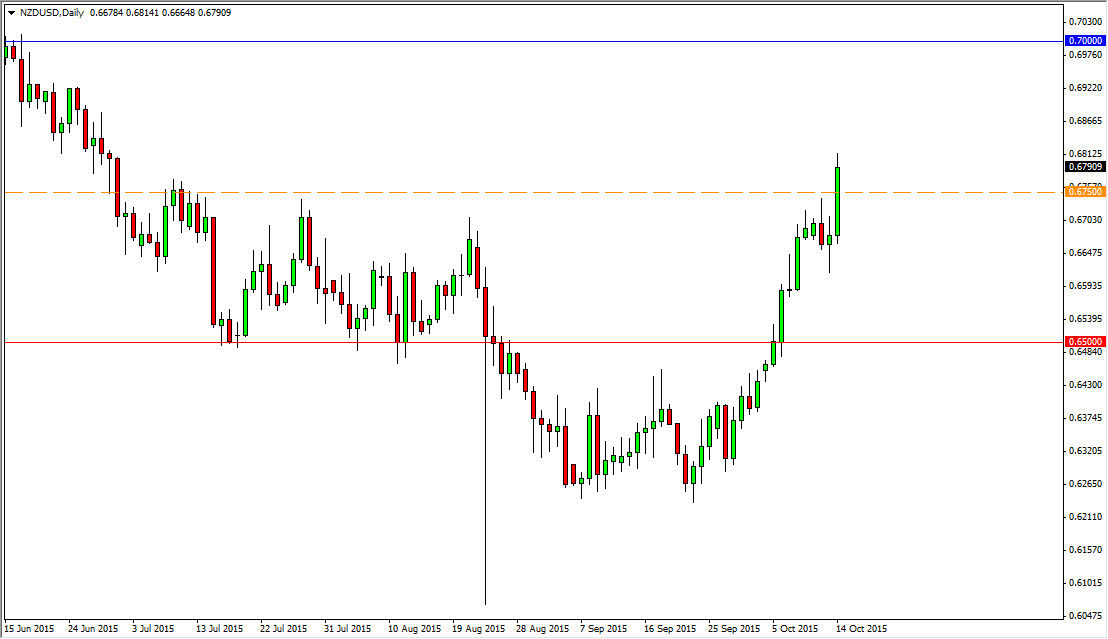

The NZD/USD pair had a very strong session on Wednesday, breaking the top of the hammer from the Tuesday session, and then of course going above the orange dashed line that I have on the chart. This is an area that was essentially a “line in the sand” for the sellers, and it has been broken. Because of this, I feel that if we can break above the top of the impulsive green candle for the Wednesday session it will be an opportunity to start buying. At that point in time, the market should then reach towards the 0.70 level, which is an area that was previously massive support. It should be resistance now, but certainly looks like an intriguing target at this point in time. I believe pullbacks will also be buying opportunities going forward, so therefore I essentially don’t have a scenario in which I am willing to sell this market until we break down below the bottom of the range for the Wednesday session, if not the Tuesday session.

This might be more about the US dollar than anything else

I think that this move is probably going to be more about the US dollar in general. After all, it is losing strength against most currencies, and as a result the New Zealand dollar is benefiting. I think that the commodity markets could pylon the bullish reasons for the New Zealand dollar to go higher, but at this point in time I think this is simple short covering.

The real fight will be now at the 0.70 level. If we can break above there, I feel at that point in time the trend has essentially changed. Ultimately, that is going to be a significant fight but I do think it will happen. This move recently that we have seen against the US dollar has been very impulsive, and it looks like we should see more.