Gold prices declined $11.01 an ounce yesterday as a strong rally in the U.S. dollar pushed prices down. The XAU/USD pair initially rose during Wednesday's session, at one point traded as high as $1183 an ounce, but reversed its course and slumped to the lowest level in almost three weeks after the Federal Reserve hinted at a possible rate hike at a final 2015 meeting in December.

Federal Reserve officials kept short-term interest rates unchanged near zero but the change in the language in the statement was quite interesting. The Committee removed its caution that “Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation” and mentioned that a decision to tighten policy could be taken at the next meeting.

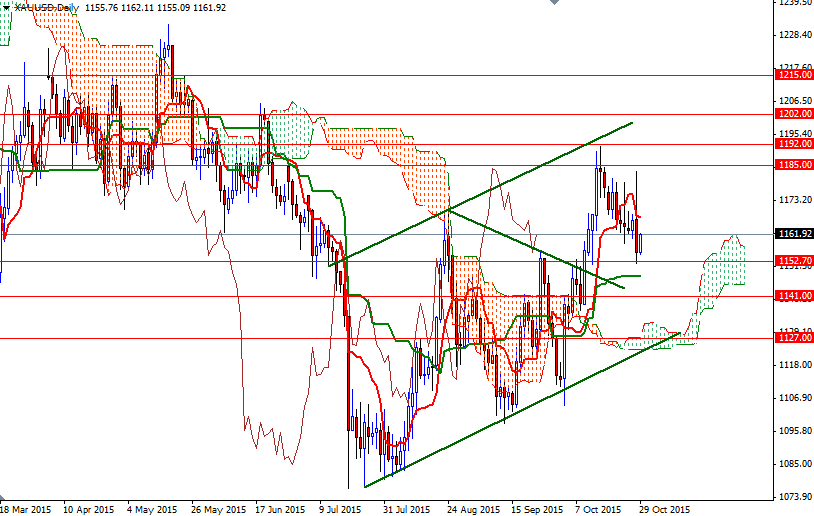

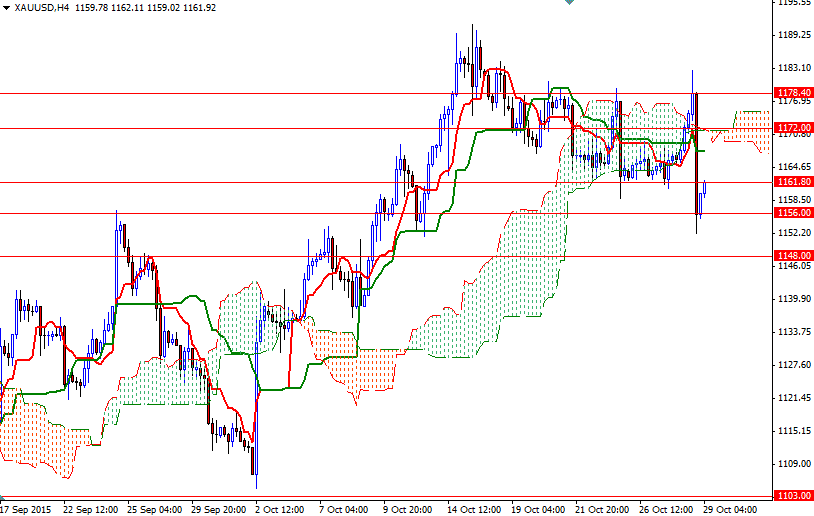

The XAU/USD pair is trading at 1161.92, higher than the opening price of 1155.83. The support in the 1163/1.80 had held the market up earlier but finally was broken yesterday, in other words, it looks like a classic break and retest scenario in play. That said, the 1163/1.80 region has now probably flipped from support to resistance so unless the market anchors somewhere above 1163, prices won't have much room to rise. A break above 1163 might give the bulls enough power to challenge the 1168 hurdle where the daily Tenkan-sen (nine-period moving average, red line) currently resides. Beyond that, the 1172 will be resistive. If the market can't penetrate 1163/1.80 and prices drop through 1156, we will probably see the market revisiting the support at 1152.70. The bears will have to demolish this significant support so that they can test 1148 and 1141 afterwards.