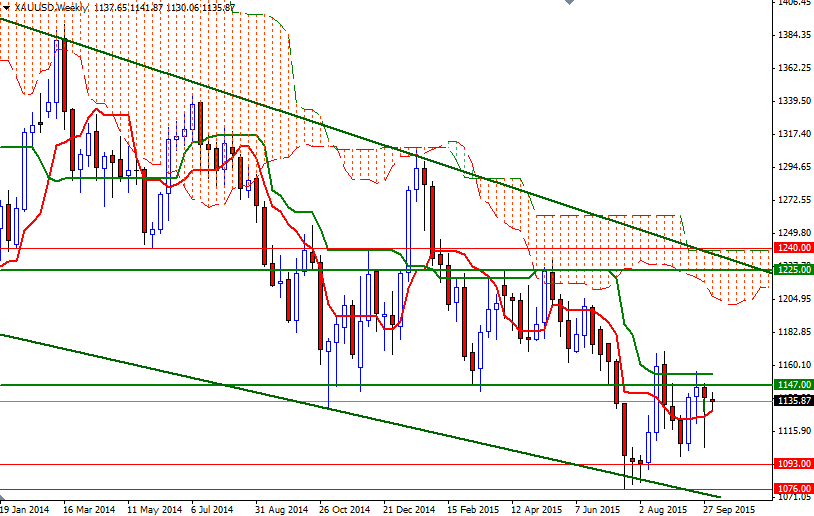

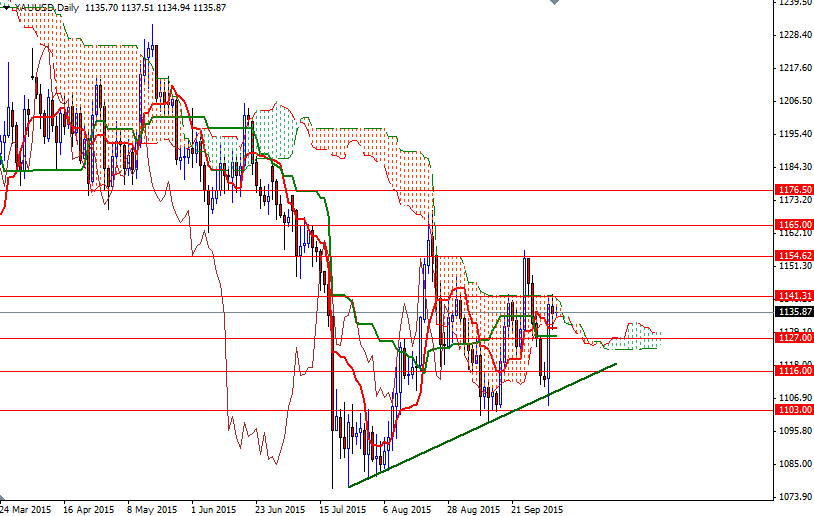

Gold prices ended Monday's session down $2.09 as investors took profits from a rally spurred by dreadful U.S. jobs data that pushed back expectations of an interest rate hike by the Federal Reserve to early 2016. In economic news yesterday, the Institute for Supply Management's non-manufacturing index came in at 56.9, down from the previous month's 59.0 and below expectations for a reading of 58.0 - more signs of weakness in the economy. The XAU/USD pair initially tested the support around the $1130 level where the daily Tenkan-Sen (nine-period moving average, red line) sits before making another attempt to break through the $1142 level. But as you can see the market encountered resistance and retreated to the current levels.

Technically trading within the borders of both the daily and 4-hourly Ichimoku clouds suggests that the market is looking for direction. Despite the fact that the broader directional bias remains weighted to the downside, bullish Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-day moving average, green line) crosses on the shorter-term charts implies that a test of 1147 is possible if the 1142 resistance level is cleared.

The bulls will have to overcome the resistance at 1147 in order to set sail for the 1154.62. Closing beyond that could attract new buying and open a path to the 1165 level. However, if the top of the daily Ichimoku cloud continues to block the bulls' progression, we may see XAU/USD testing the support around 1130 again. There is another crucial support not far below that in the 1127/3 area. If the bears regain some strength and drag prices below 1123, it is likely that the XAU/USD pair will revisit the 1116 level.