Gold prices ended Friday's session down $5.12, to settle at $1177.50 an ounce as a rebound in the dollar prompted some investors to lock in gains from a recent rally to a three-and-a-half-month high. In the latest economic data, the University of Michigan's preliminary reading on the overall index on consumer sentiment for October came in at 92.1, exceeding consensus estimates. The Federal Reserve's industrial production data was bleak but was more or less in line with market expectations. Despite Friday's losses, the precious metal ended the week with a gain of $21.72 as the possibility of a delay in raising interest rates helped the bulls push prices higher. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 117159 contracts, from 86819 a week earlier.

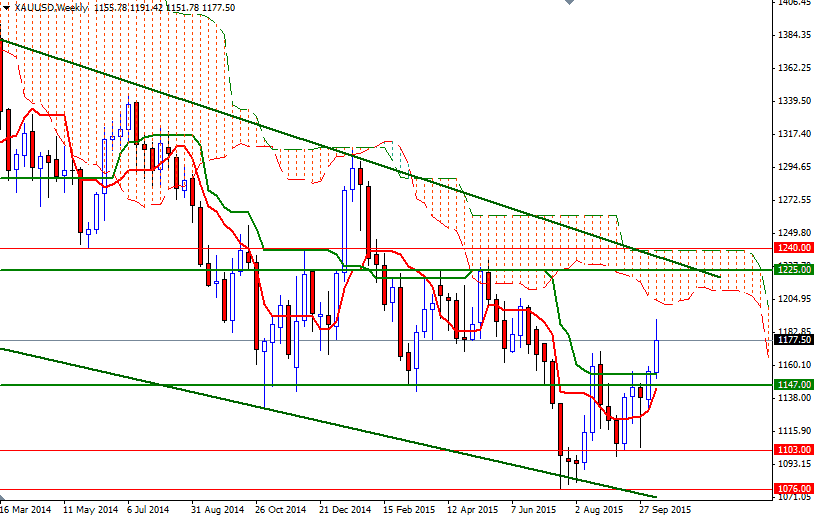

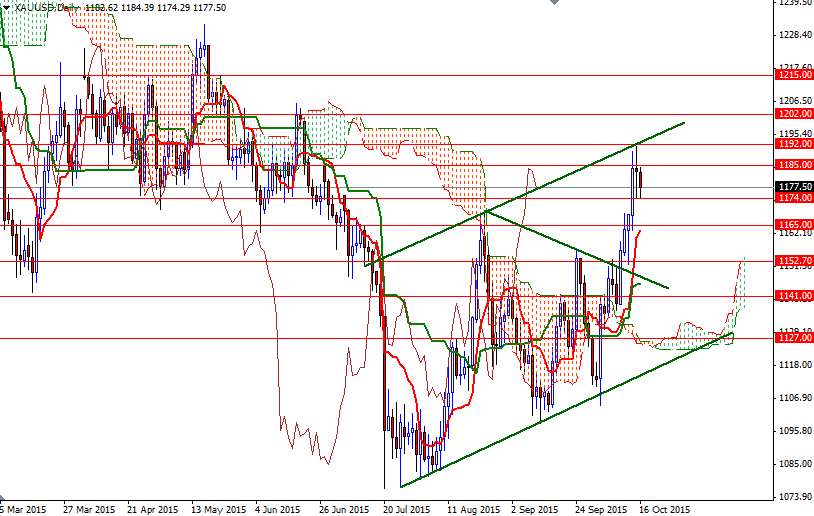

Speaking strictly based on the charts, I think there are two things to pay close attention: the descending channel dating back to July 2013 (weekly chart) and a short-term ascending channel (daily chart). The XAU/USD pair has been following this short-term ascending channel since prices bottomed out around the 1076 level - where the lower trend-line of the long-term descending channel resided. This suggests that the market will have a tendency to rise towards the upper trend-line of the descending channel, unless prices break below the short-term ascending channel. The bottom the ascending channel is supported by the daily Ichimoku clouds but similarly the anticipated resistance around the top of the descending channel is increased by the weekly Ichimoku cloud.

From an intra-day perspective, the key levels to watch will be 1185 and 1174. If the bulls successfully push the XAU/USD pair beyond 1185, we will probably see prices revisiting the 1192 region. Breaking above the upper trend-line of the ascending channel would make me think that XAU/USD is on its way to the 1202/0 area. On the other hand, if the exhaustion appeared near the upper trend-line (1192) persists and the support at 1174 fails to hold the market, then the next stops will probably be 1171 and 1165/3. Closing below 1163 on a daily basis may trigger additional profit taking and increase the possibility of XAU/USD testing the 1152.70 support.