Gold prices edged slightly higher on Tuesday, putting an end to four-session streak of declines, as the U.S. dollar weakened after a series of economic data out of the world's largest economy disappointed the markets. Data released by the Commerce Department showed orders for durable goods fell 1.2% in September (orders for August were also revised lower) and the Conference Board said that its consumer confidence index dropped to 97.6 from 102.6 the prior month. Markit reported that its flash purchasing manager's index on the US services sector fell to 54.4 from 55.1

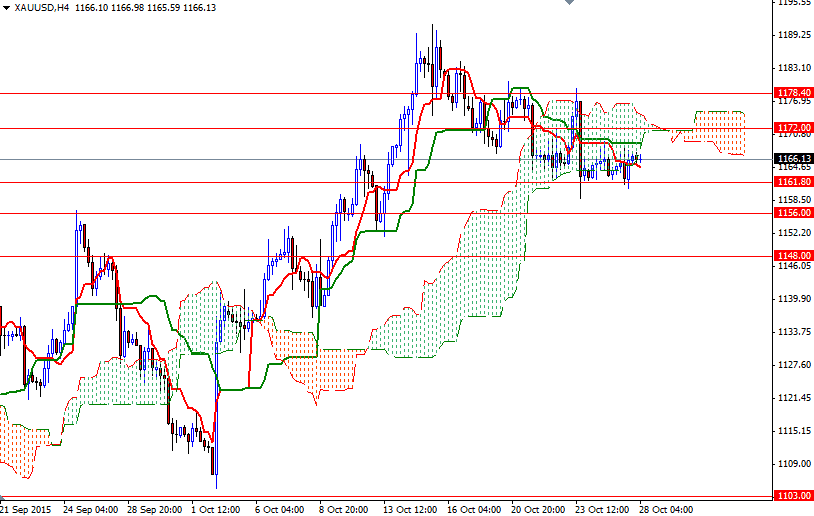

The XAU/USD pair bounced off the support around 1161.80 but we are still in the same trading range that imprisoned us for the past few days. Market players are understandably in a more cautious mode ahead of a Federal Reserve policy statement later in the day. The Fed is widely expected to leave rates unchanged but uncertainty over whether it would hike rates at its next meeting in December still persists.

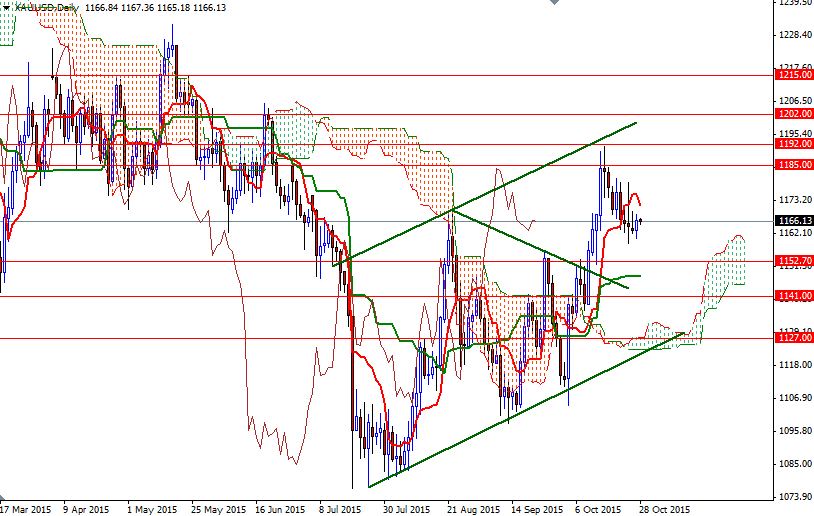

Since we have been moving in a relatively tight range, the overall technical picture has not changed. It appears that the key levels (the 1172/0 area on the top and 1163/1.80 area on the bottom) are likely to hold until the Fed statement. Although the market found some support around the 1161 level, the pair has to push its way through the 1172/0 resistance zone in order to gain more momentum and tackle the 1178.40 barrier. If the market can cleanly break above the 1178.40 level, we could see a bullish run targeting the 1185 and possibly 1192 levels. On the other hand, if the 1161.80 support is broken, the 1156/2.70 area will probably be the next port of call. The bears will have to capture 1152.70 so that they can have a chance to make an assault on the 1148 level.