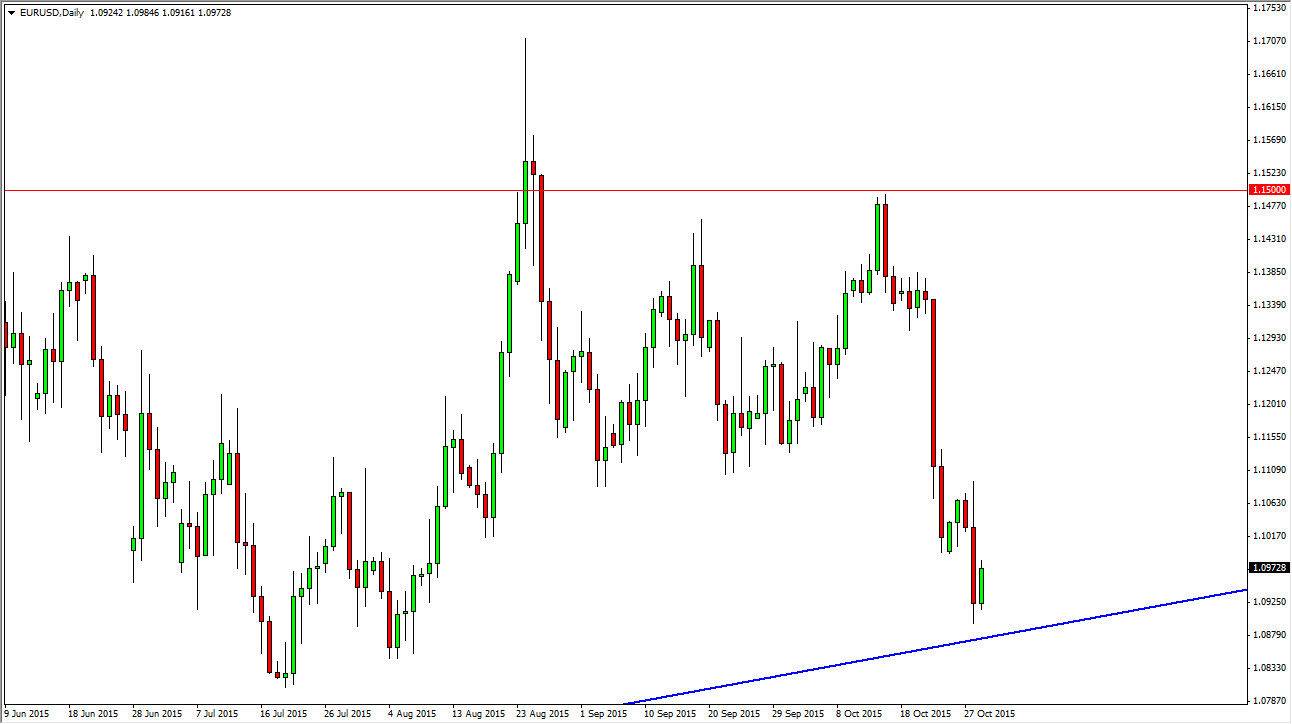

During the session on Thursday, the EUR/USD pair bounced enough to show that there is indeed support at the uptrend line that had continued to push this market higher and form an ascending triangle on the longer-term charts. Because of this, I believe that this market is ready to continue going higher at this point in time, although I think that choppiness is the norm in this pair going forward.

The main reason I believe this, is that we have a couple of central banks and are trying to fight the value of their currencies. In other words, we have the Federal Reserve who has stated a couple of times recently that they cannot raise interest rates, but it isn’t because of America, it’s because of the rest of the world. While I don’t necessarily believe that, the reality is that it is returned going higher anytime soon. This of course puts bearish pressure on the dollar.

But what about the Euro?

Well at this point in time I believe that the European Central Bank has decided that stimulus is probably going to have to happen. With this being the case, it will drive down the value of the euro overall, but ultimately we have 2 currencies that are fighting to be the softest that they can be. In other words, there will be a lot of back-and-forth type of action on short-term charts and therefore it’s difficult to imagine that markets will move in one direction or the other for any real length of time at this point in time.

I think that we are going to go higher based upon the bounce, but that’s about it. The uptrend line of course should keep this market going higher in the short-term, but I think that there is a significant amount of resistance at the 1.11 level. With this, I believe that we rise, but are not going to go any higher than that in the short-term. Quite frankly, you would not be blamed for sitting on the sidelines.