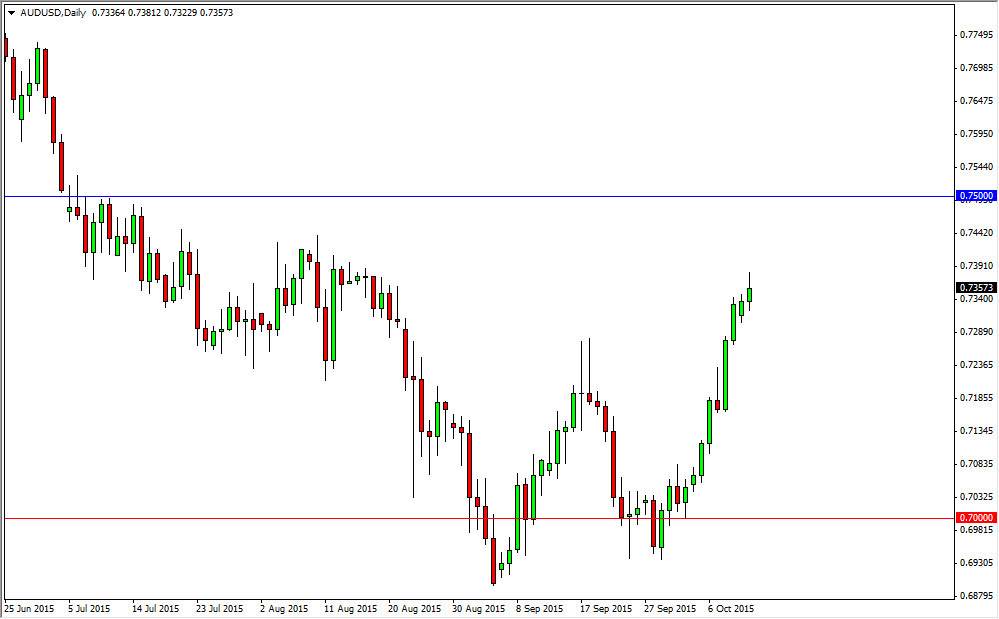

The AUD/USD pair initially showed strength during the Dem Monday, but as you can see pulled back a bit and then formed something akin to a shooting star. Yes, it’s not quite a perfect shooting star, but at the end of the day I recognize that there is a pretty massive cluster all the way to the 0.75 level, and we are overbought by any measure at this point. That’s not to say that there isn’t any strength here just that at the very least we need to take a bit of a breather.

That being the case, I feel that a break down below the bottom of the range for the session on Tuesday should be a short-term selling opportunity. I believe the market will then reach towards the 0.72 handle, and perhaps even lower if we can pick up the momentum. That being the case, I would not hesitate to sell.

Gold markets

Gold markets have been strong lately, but they have not completely broken out. I think until that happens, the Australian dollar will not be able to do so either. I look at “broken out” as technically being above the 0.75 handle, and although we have seen quite a bit of strength lately, we still haven’t done that. Quite often, you will see moves like this fail just simply because there is not enough momentum to keep this type of pace. You simply have had a very impulsive move, which generally comes down and relatively short order.

On the other hand though, if we can break above the 0.75 level I feel that the trend has changed at that point. We would go to at least the 0.80 level, if not higher than that. The Australian dollar is at extreme lows, so I do feel that sooner or later value hunters will come into the marketplace, but they most certainly have a lot of work to do and will have to be very patient.