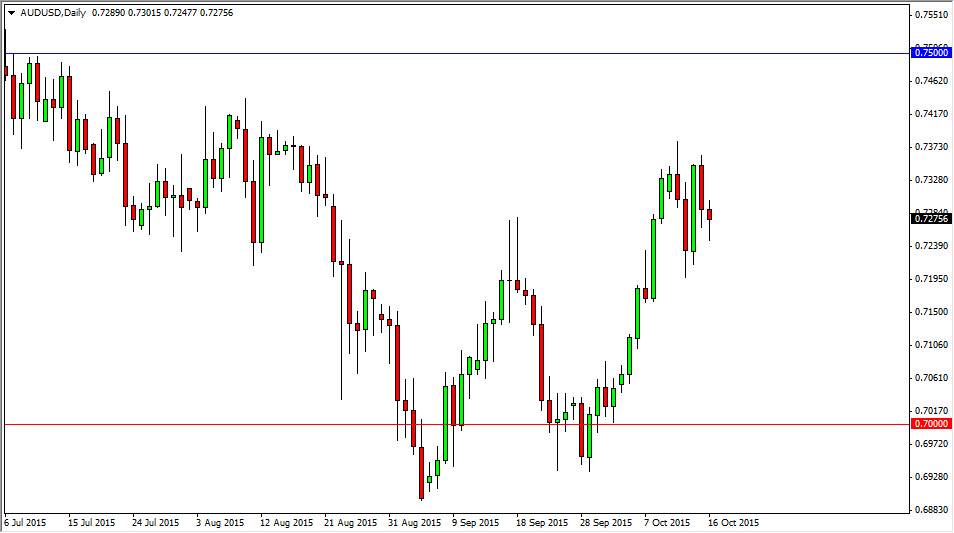

The AUD/USD pair initially fell during the course of the session on Friday, but found enough support near the 0.7225 level to turn things back around and form a hammer. By doing so, it looks as if the market is ready to go higher, and a break above the top the hammer probably sends this market back to the top of the recent consolidation area. I think that ends somewhere near the 0.74 handle, and that there is a significant amount of resistance all the way to the 0.75 handle. In fact, I believe that the 0.75 level is so important that if we can break above there, it would be a bit of a trend change at that point. Ultimately, the market should continue to much higher above there. I do believe that we are going to challenge that area, but it’s not like it can be an easy move to make.

The Aussie mirrors gold

The Australian dollar tends to mirror gold, and knowing that it’s not surprising that we are seeing the gold market try to break out to the upside. However, in that market we see a significant amount of resistance just above. That’s a very similar to when I see between here and the 0.75 level, and I think both of those markets are getting ready to break out to the upside. This isn’t going to be easy, see you are going to have to be able to deal with quite a bit of volatility. On a break of the top of the hammer from the Friday session, I think you can buy the Australian dollar.

On the other hand, we may break down below the bottom of a hammer and although that would normally be a sell signal, I would need to see broad US dollar strength around the Forex world in order to start selling. Right now I don’t think that’s going to happen anytime soon. Essentially, I think that this could be a bit of an investment, and not so much of a trade as I buy Aussie dollars.