AUD/USD Signal Update

Yesterday’s signals were not triggered as the bearish price action at 0.7143 came way too late to line up a good short trade on the hourly chart.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be made between 8am and 5pm New York time today only.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7072.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

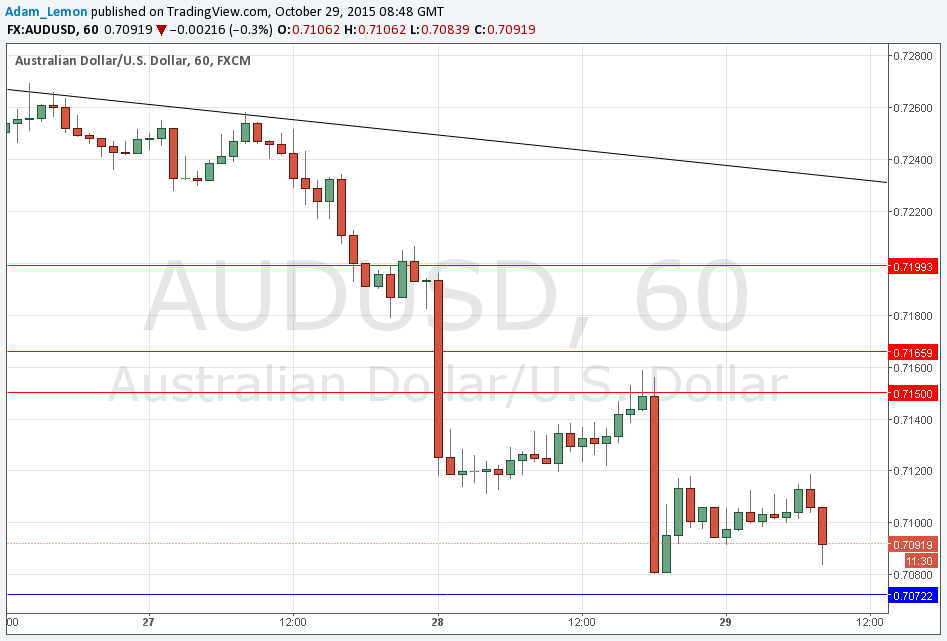

Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 0.7150 and 0.7166.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7200.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

The downwards move continues as the AUD weakness holds and the USD is strengthened following yesterday’s FOMC announcement which has made a US rate hike in December seen as more likely to happen by the market.

The pullback following the sharp downwards leg reached 0.7120 which looks to be an area of minor resistance now. The price is following a classic downwards trend pattern so it seems likely that we are going to reach the anticipated support at 0.7072. Be very careful looking for a long reversal here: it should be very convincing before going long of this pair.

Regarding the USD, there will be a release of the FOMC Statement and Federal Funds Rate at 6pm London time. There is nothing due concerning the AUD.