USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 118.00.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Short Trade 1

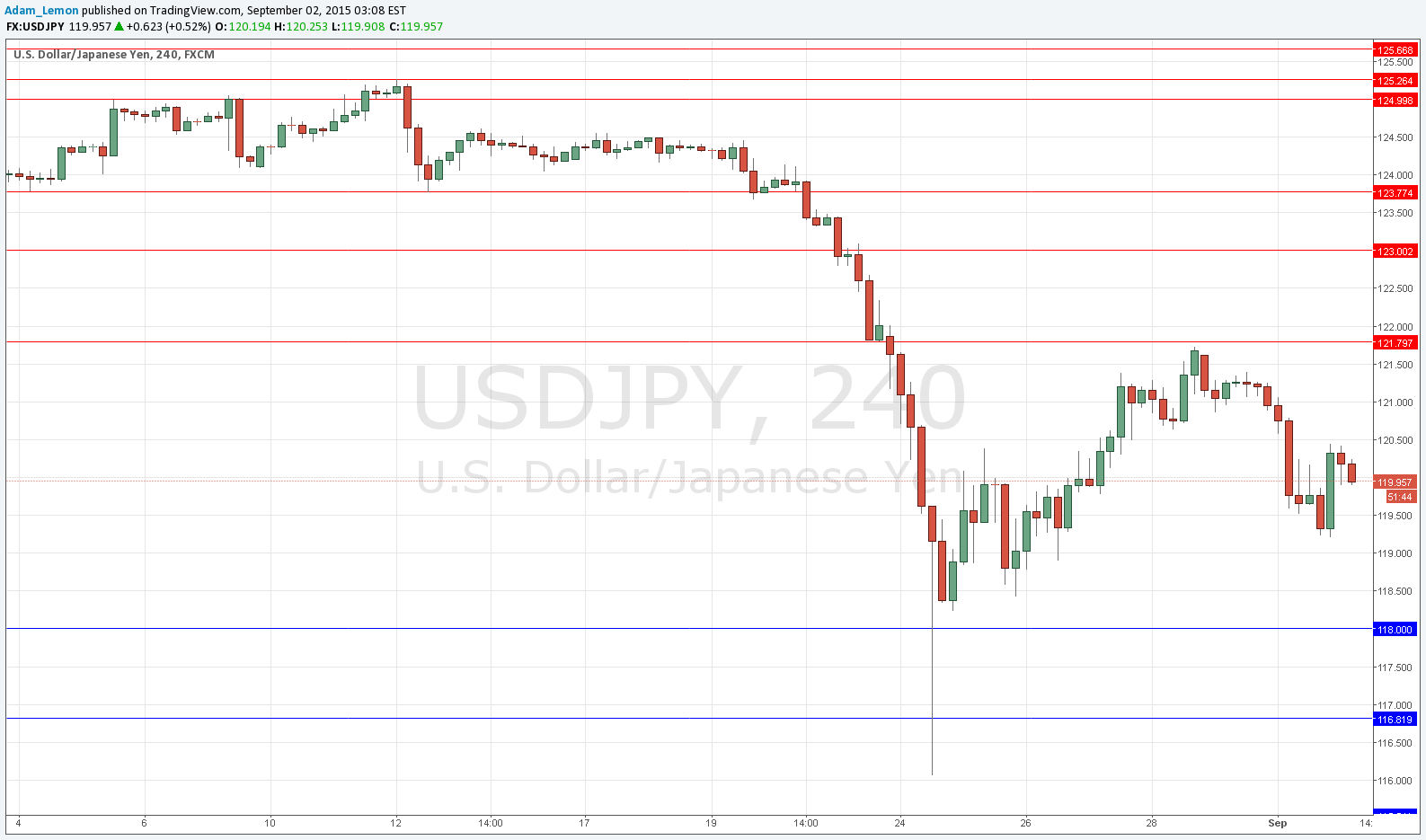

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 121.80.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 25 pips in profit.

Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

Yesterday continued the pair’s selloff from the level very close to the major resistance that was reached at about 121.75, although there was a pull-back upwards during the Asian session. It appears right now the JPY is strengthening again even though the USD is fairly firm against other currencies. Overall, it is muted continuation of yesterday’s conditions as the market awaits the big USD data releases over the coming days that are quite probably going to be crucial in setting the tone of the Forex market over the coming months, as they will probably determine whether the Fed will raise the interest rate this month or not.

The Yen is quite strong overall so if the Fed disappoints, this pair should make a meaningful downwards move. On the other hand, if the USD starts to really take off again, it seems that this pair will not be the best pair to trade to take advantage of such a move.

There is local support beginning at around 119.25 and this probably stretches all the way down to the key level at 118.00.

There is nothing due today regarding the JPY. Concerning the USD, there is be a release of ADP Non-Farm Employment Change data due at 1:15pm London time.