USD/CHF Signal Update

Last Thursday’s signals were not triggered as the price did not reach 0.9800 until the next day.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trade 1

Go long after bullish price action on the H1 time frame following a touch of 0.9625.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long after bullish price action on the H1 time frame following a touch of 0.9550.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 3

Go long after bullish price action on the H1 time frame following a touch of 0.9500.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

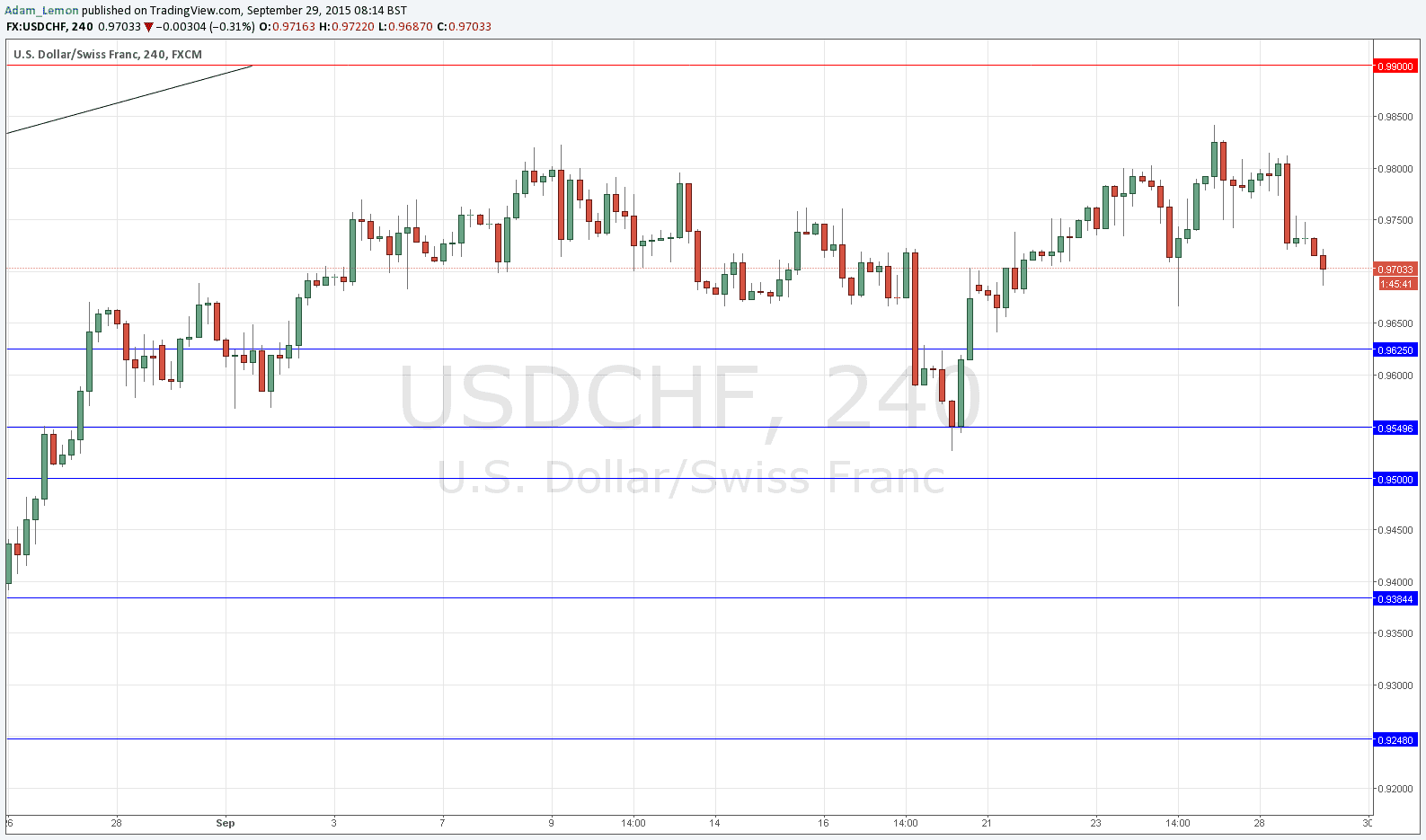

USD/CHF Analysis

The market is quite mixed up at the moment. This pair has a small upwards trend due to relative USD strength and the CHF’s strongly negative interest rate. However it still tends to consolidate and as such it respects support and resistance levels, especially round numbers.

This pair has been moving up for about the last month or so but cannot really break above 0.9800. As such it looks quite likely to pull back now to at least 0.9625 where there will probably be some buy order. There should also be clusters of buy orders at around 0.9550 and of course the key psychological level of 0.9500, so all three levels should be good points at which to seek to go long.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time.