USD/CHF Signal Update

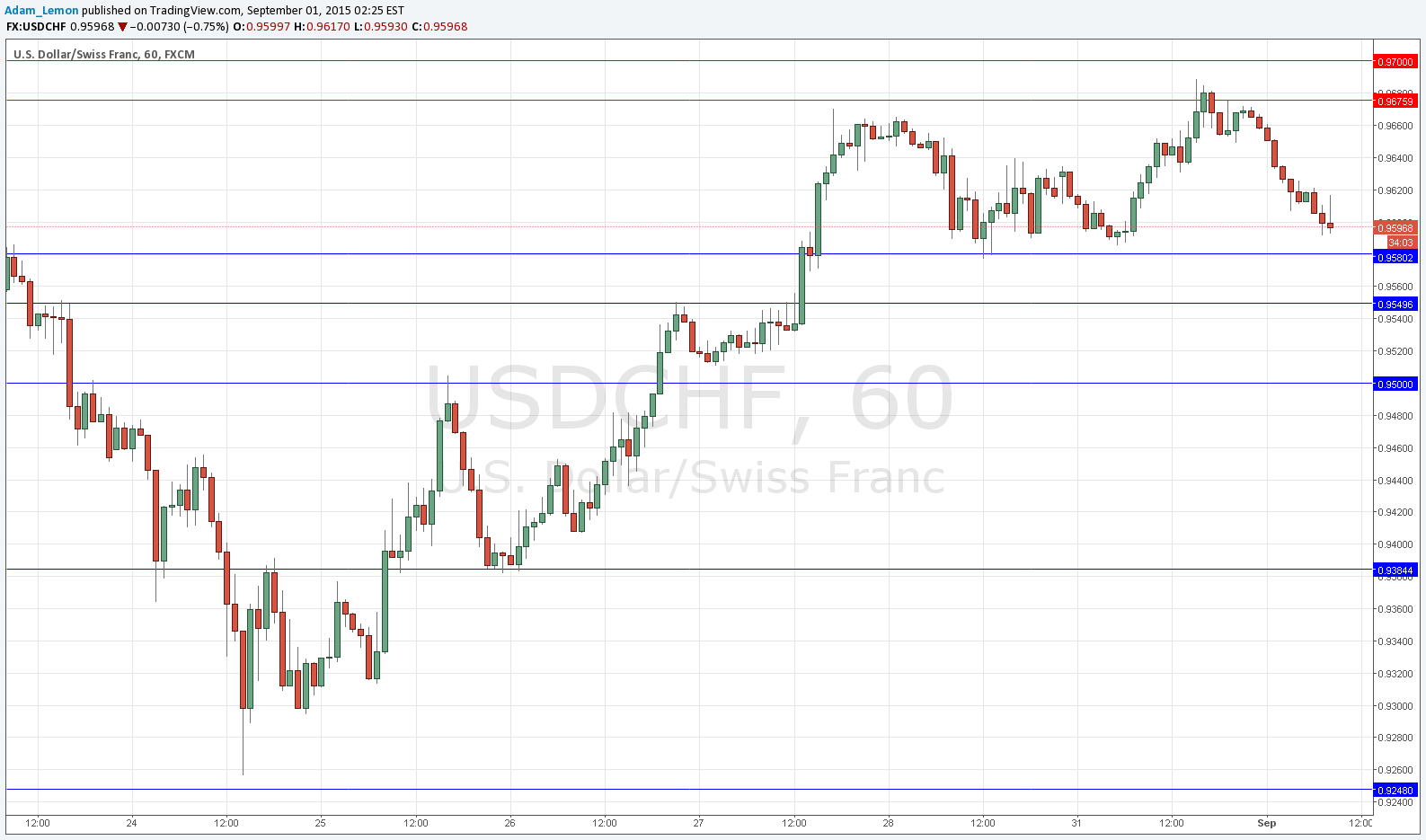

Yesterday’s signals would have triggered a good, profitable short trade from the bearish reversal off the resistant zone from 0.9675 to 0.9700, but the reversal happened just after the London close so the trade was not to be taken.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trade 1

Go long after bullish price action on the H1 time frame following a touch of 0.9580.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Long Trade 2

Go long after bullish price action on the H1 time frame following a touch of 0.9550.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Long Trade 3

Go long after bullish price action on the H1 time frame following a touch of 0.9500.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

Short Trade 1

Go short after bearish price action on the H1 time frame following an entry into the zone between 0.9675 and 0.9700.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 30 pips in profit.

Remove 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair behaved very nicely yesterday, with predictable and orderly bounces between support and resistance. The upwards move continued and turned around very predictably at 0.9675. From there is has moved down during the late New York and Asian session and is now not far from support at 0.9580 from which it is probably going to rise. This looks like an excellent pair at the moment for trading support and resistance level reversals. This is supported by the longer-term picture which shows a contracting consolidation following the price shock earlier in the year which is still ongoing.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of ISM Manufacturing PMI data due at 3pm London time.