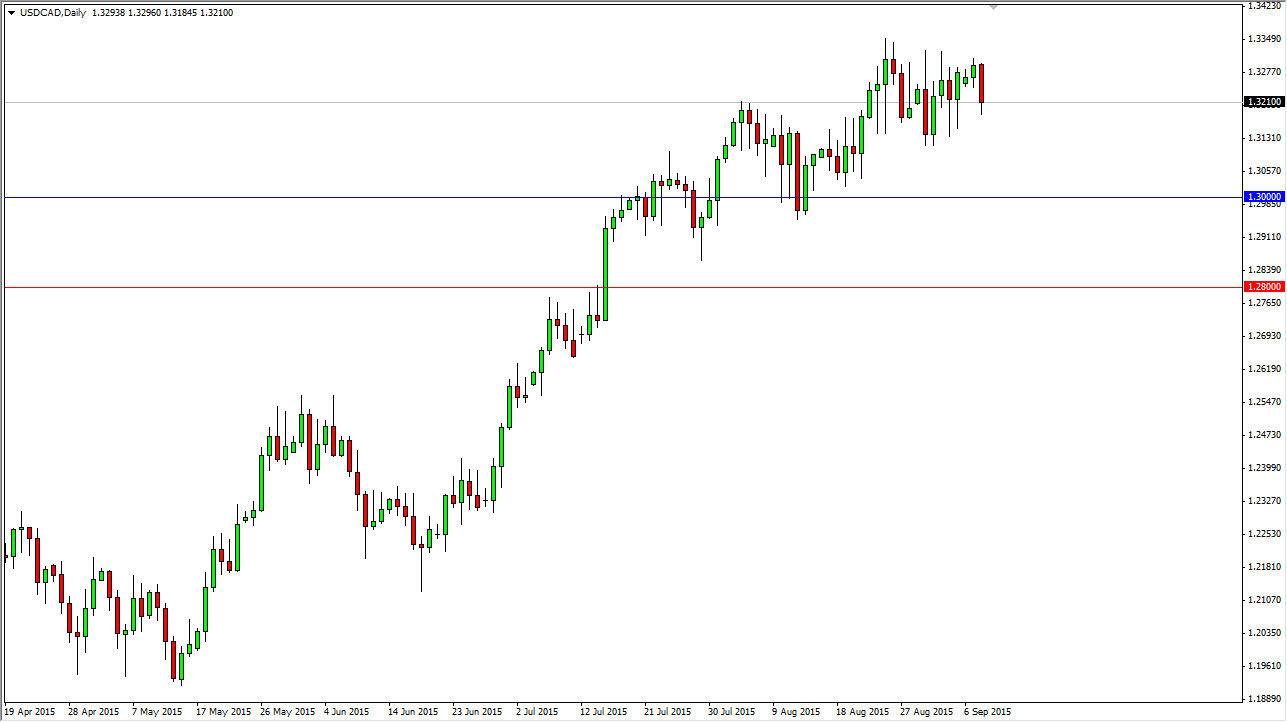

The USD/CAD pair fell during the course of the day on Tuesday, testing the 1.32 level. However, the market is one that I have no interest whatsoever in selling this market as the oil markets, although strengthening recently, still don’t suggest that the Canadian dollar should be highly valued. Ultimately, this market is one that I will buy and buy again, as the Canadian dollar should continue to lose strength. After all, we have broken above a significant resistance barrier in the form of the 1.30 level, an area that was massive in its implications during the financial crisis. After all, the market slammed into this area 4 or 5 times, and then simply fell.

Now that we have broken above there it makes sense that it should now be supportive. In fact, I feel that there is a support barrier between the 1.30 level and the 1.28 level that now makes this a bullish market. With this, I have absolutely no interest in selling anytime soon at least until we get below the 1.28 handle, and I don’t expect to see that happening anytime soon.

Bank of Canada

The Bank of Canada has an interest rate decision today, and as a result I think there will be quite a bit of volatility in this pair. Ultimately though, I hope this pair pulls back so I can pick up value at lower levels. The Canadian economy simply does not warrant higher value in the Loonie, and as a result I feel it’s only a matter time before the buyers step back into this market every time it pulls back as the US dollar will be “cheap” at that point. I think that we are getting towards a move higher, and we will more than likely head towards the 1.35 level over the course of the next couple of weeks. Long-term, I am buying pullbacks as they appear.