Gold prices initially fell on Monday but the expected support at the 1125.50 level which happens to be the daily Kijun-sen (twenty six-period moving average, green line) kicked in and pushed the market up. The XAU/USD pair continued to grind higher during today's Asian session as downbeat Chinese manufacturing data compounded fears of a sharper slowdown. While the official Purchasing Managers' Index came in at 49.7 in August, down from the previous month's 50.0, data compiled by Caixin/Markit showed the lowest reading since March 2009.

The recent turmoil triggered by fears that China's economy is faltering has fanned speculation that the Fed might delay interest rate hikes. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 70733 contracts, from 41659 a week earlier.

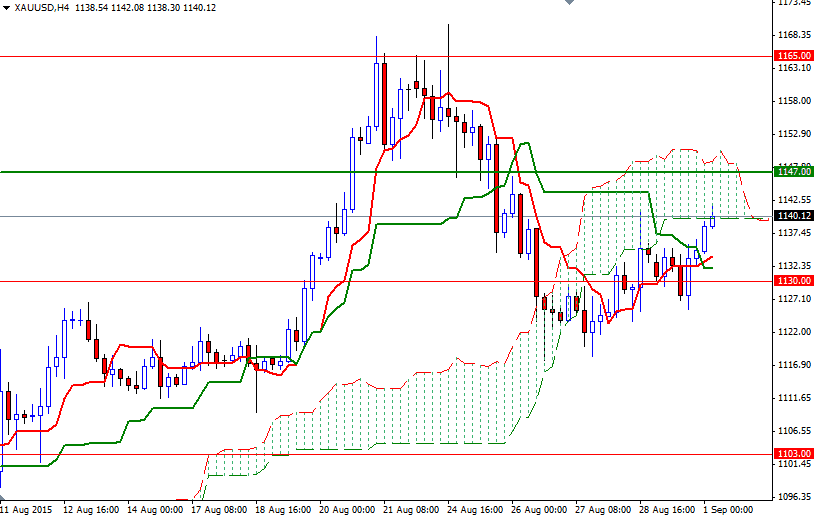

Currently the XAU/USD pair is trading beyond the 1130 level but the technical outlook remains mixed. As you can see on the charts, the XAU/USD pair is trading within the borders of the Ichimoku cloud, acting as a resistance. However, we have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen crosses on the daily, 4-hourly and hourly charts, suggesting that a test of 1147 (or even 1151) is possible if the 1143.86 resistance level is cleared. The market has to break through 1151 in order to test the next barrier at 1154.61 which holds the key to the critical 1165 level. If the bulls fail to push the market above the 1143.86 level where the daily Tenkan-sen line resides and prices start to fall, expect to see some support at 1134 and 1130. The bears have to drag XAU/USD back below 1130 if they intend to make an assault on the 1125.50 support level.