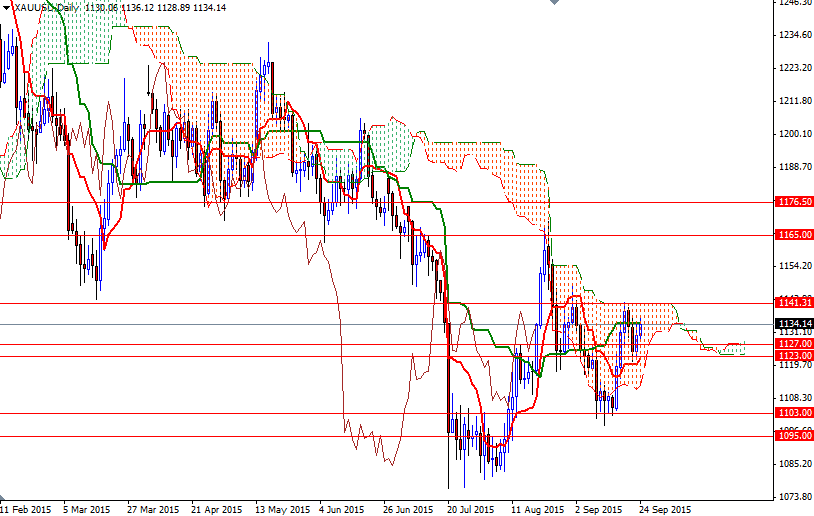

Gold turned higher on Wednesday as declines in equities sparked by weak Chinese factory data made gold more attractive as an alternative asset. The XAU/USD pair continued to advance during today's Asian session and traded as high as $1136.12 an ounce. Technically speaking, the Ichimoku cloud indicates an area of resistance (or support depending on its location) so basically the trend is up when prices are above the cloud, down when prices are below the cloud and flat when they are in the cloud itself.

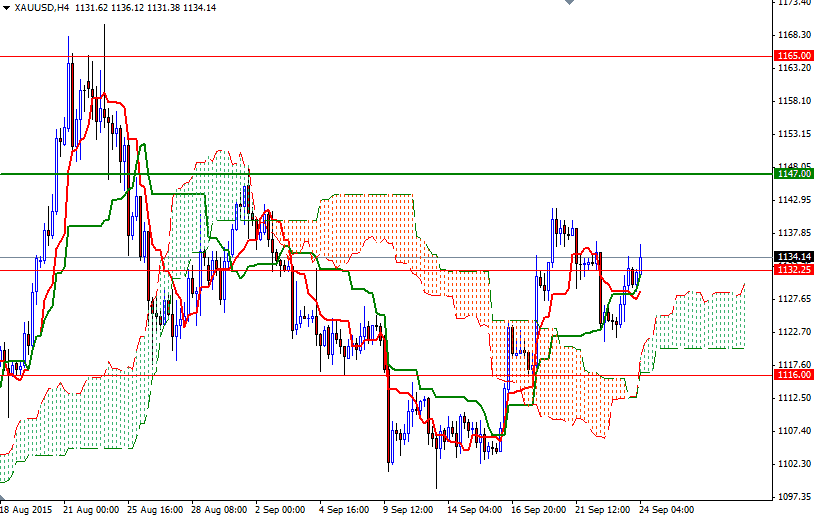

Although trading inside the daily Ichimoku cloud suggests that the market is not out of the woods yet, the outlook on the 4-hour chart is bullish with the market trading above the Ichimoku cloud on the 4-hour chart. Plus, the Chikou-span (closing price plotted 26 periods behind, brown line) is also moving beyond the cloud. The daily Kijun-Sen (twenty six-period moving average, green line) currently sits at 1134.35 so the market has to climb and hold above there in order to test the next barrier at 1141.31. A sustained break above the top of the daily Ichimoku cloud could prolong the bullish momentum and suggest that a test of 1147 (1147.95) is possible.

On the other hand, if the bears increase the downward pressure and drag prices back below 1132.25, then it is likely that the market will retest the support at 1127. Below that, the next obvious support level is around the 1123 level. Closing below the 1123 support would open up the risk of a move towards 1116.