The GBP/USD pair initially fell during the day on Monday, but found enough support near the 1.5350 level to turn things back around and form a nice-looking hammer. The hammer of course is a very positive sign, but I have a lot of concerns about going long of this market right now. After all, I think the next couple of days will be very quiet, as what should be the catalyst for this market going forward is happening on Thursday. I am of course talking about the Federal Reserve interest rate decision.

I believe that the market will simply go back and forth but is trying to give us an idea of which direction we are heading next based upon the hammer. Nonetheless, it is not going to be easy to deal with the area just above, as there are a lot of negative signs just above that will more than likely continue to affect the market.

Tight range until Thursday?

It’s likely that we will keep a tight range until Thursday, but I am willing to pay attention to this market. After all, I like the idea of trading this market after the announcement, but recognize that there is far too much in the way of unpredictability going forward. After all, the market is trying to figure out whether or not the Federal Reserve will raise interest rates to begin with, and then after that whether or not we are facing an interest rate tightening cycle, or simply a market that will have to wait for that type of movement. It of course is going to greatly influence what happens with the US dollar going forward, and by extension this particular market.

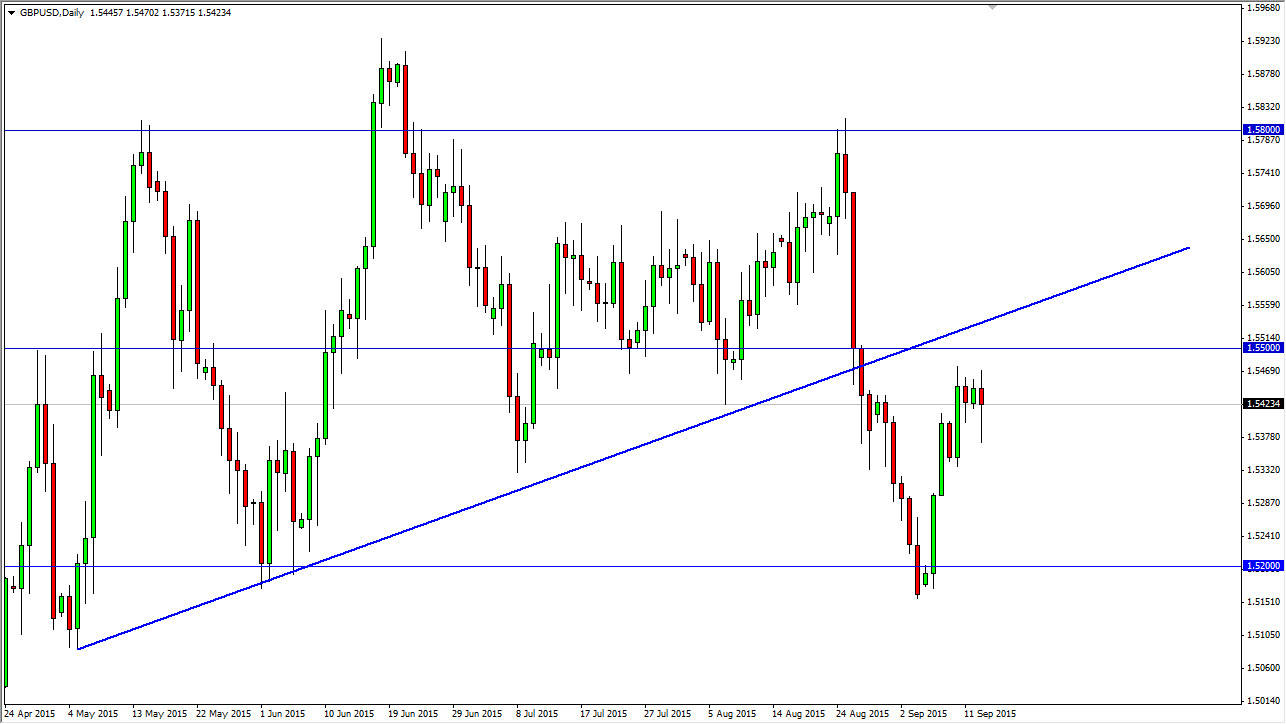

Looking at the technical side of things, I believe that the 1.55 level above should be massively resistive due to the fact that was massively supportive in the past. However, I also see that there is an uptrend line that supportive this market during the course of the summer which should now be resistance. It is because of this that I think it’s going to be difficult to go long without the catalyst coming out of the central bank. If we get above both the 1.55 line and the uptrend line, I feel we go to the 1.58 handle. On the other hand, if we break down below the bottom of the hammer, we should then drop down to the 1.52 level.