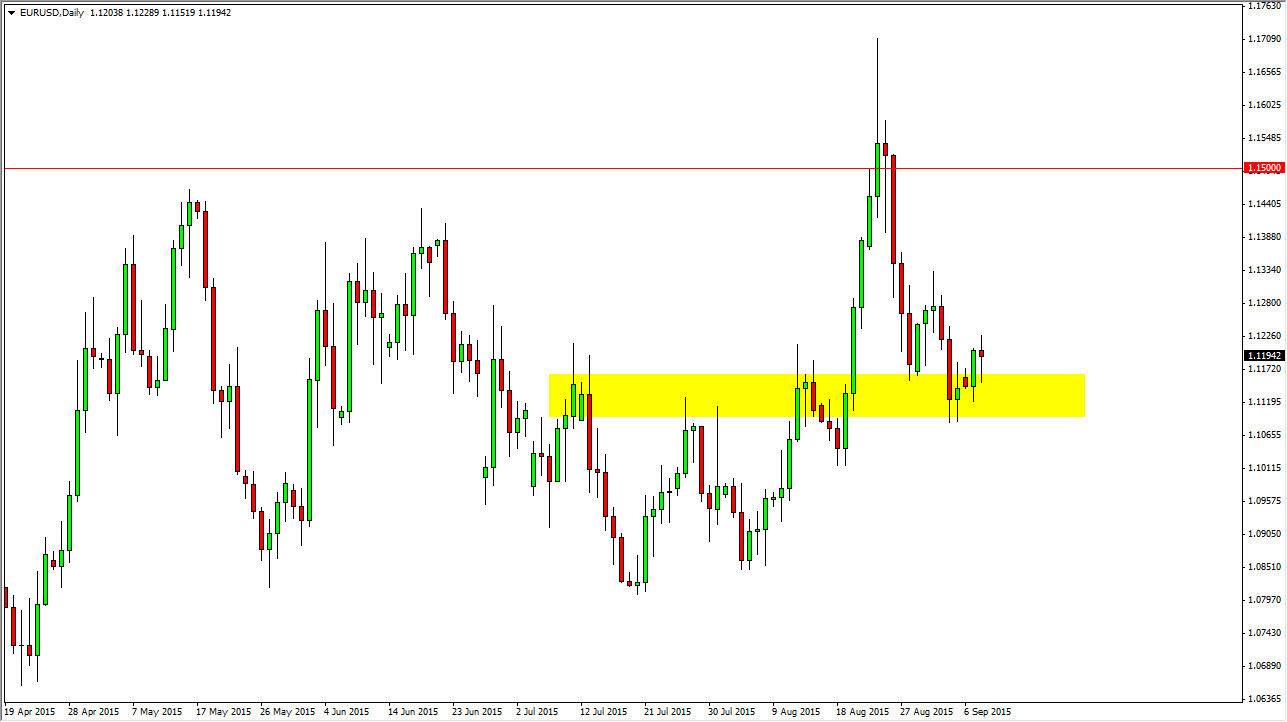

The EUR/USD pair found support again during the session on Tuesday as we initially fell. However, we bounced enough to form a nice-looking hammer, and that of course is a very bullish sign. If we can break above the top of the hammer, this market should then head towards the 1.13 level. That area is resistive, so we are looking at short-term trades to the upside at best in my opinion. I think that if we can get above the 1.13 level, this market should then head to the 1.15 level, which of course is a much larger resistance barrier due to the fact that is a large, round, psychologically significant number will of course attract a lot of attention as it did previously.

Short-term trades only

At this point in time though, I feel that this is a market that can only be traded on short-term charts, simply because there so much in the way of volatility, choppiness, and most certainly uncertainty when it comes out of the Federal Reserve. While I do believe that the Federal Reserve is still going to raise interest rates sometime this year, the question now becomes whether or not they can do that interest-rate hike in September or not. Also, they have to wonder whether or not the economy can handle a bunch of successive rate hikes. I don’t know that we’re going to get more than one rate hike, so I think that the Euro might be a bit undervalued. Because of this, I think that eventually we will see bullish behavior in this market, but at this point in time it appears that the market is still trying to read what’s going on in the employment numbers in America, which of course sets up next move by the Federal Reserve.

Over the next couple of sessions, expect quite a bit of choppiness, but it is more than likely going to give way to buying. With that, I feel that short-term trades are about the only game in town when it comes to this market.