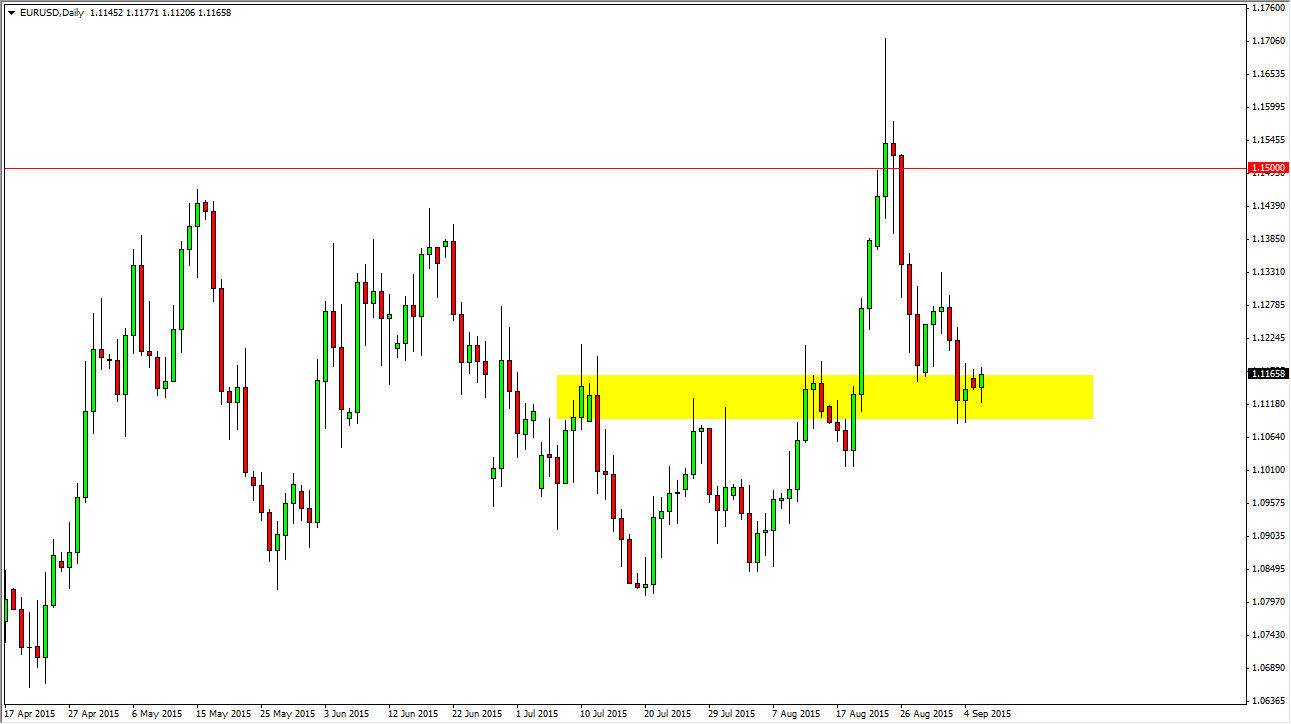

The EUR/USD pair initially fell during the course of the day on Monday, but keep in mind that it was Labor Day in the United States. This of course meant that most of the trading was done early in the day, and that the American simply did not have anything to say about the marketplace. However, I recognize that there is a significant amount of support near the 1.11 level, and as a result we turned back around to form a little bit of a hammer. Quite frankly, I feel if we can break above the top of the range for the day we will probably head towards the 1.13 level.

I also feel that you can essentially throw away the day. After all, there wasn't a whole lot moving the markets economic announcement wise, and of course liquidity. So having said that I think that we are essentially going to stay in the consolidation area that we have been in for a little while now, and this of course is especially true due to the Federal Reserve situation.

Lack of clarity

I believe that there is going to be a serious lack of clarity going forward, as the Federal Reserve isn’t exactly going to be free to raise rates or anything like that without serious thought. The economic indicators are going back and forth, and of course the market has no idea what to do with this information. I quite think that the Federal Reserve is more or less on track to do “one and done” as far as interest-rate raises are concerned, so perhaps the market is starting to understand that the Euro has been oversold.

With this, it would not surprise me at all that we go back to the 1.13 level, and then perhaps break out above there. A move above the 1.13 level since this market looking for the 1.15 handle. At this point in time, I’m not so comfortable selling this market as I see a significant amount of support just below.