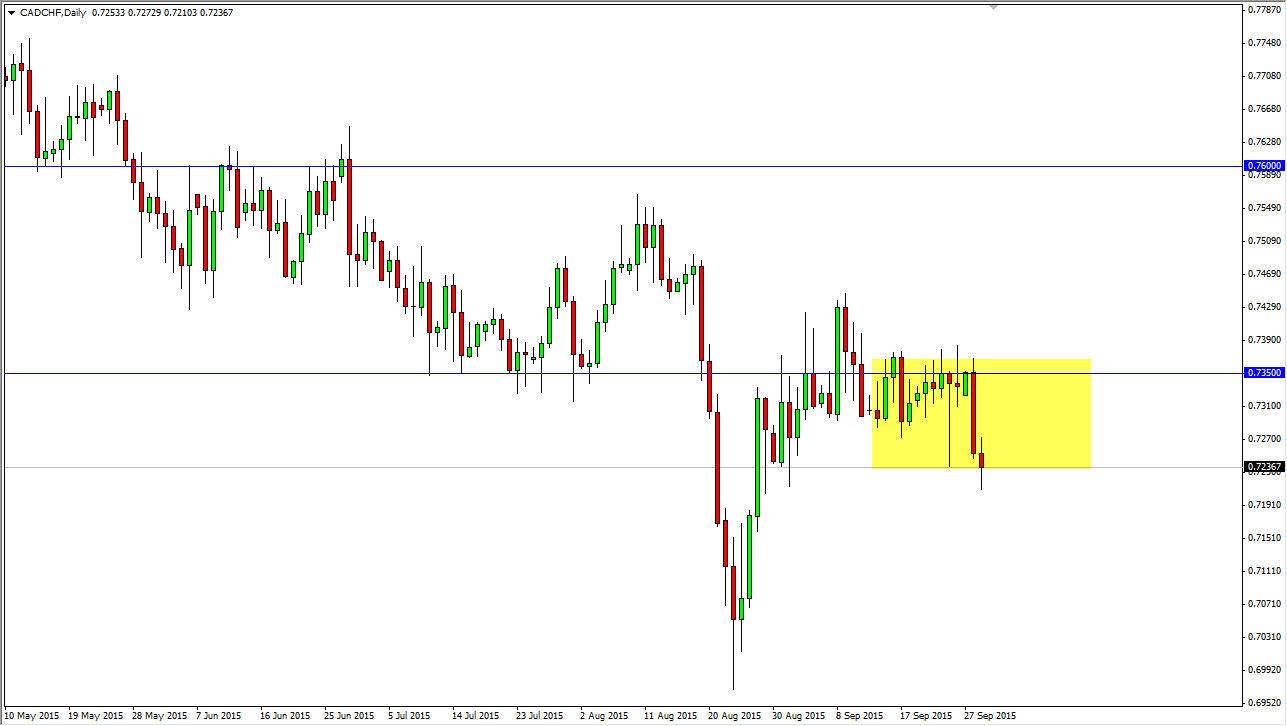

The CAD/CHF pair initially fell during the course of the session on Tuesday, but found enough support near the 0.72 level to turn things back around and form a bit of a hammer. Because of this, it appears that the market will probably try to bounce towards the 0.7350 level again. I am not calling for some type of massive breakout to the upside, just that the market should continue to be focused on this area.

Ultimately, if we did break above the 0.7350 level, the market could then go to the 0.7450 level, and then possibly even higher than that. With that being the case, I think that it would be a little bit of a trend change, or at least a relief rally of significance.

I believe that ultimately this market is of course negative, as we have dropped all the way down to the 0.70 level recently. If we rally from here, and form a resistant candle, I believe that selling will also be possible. In other words, it’s very likely that the sellers will continue to push in the same direction they have for some time now.

Oil

The Canadian dollar is of course very sensitive to the value and of course the whims of the oil markets, and with the Crude Oil Inventories announcement coming out of the United States today, we could have a bit of a shakeup in this market. As the price of oil goes higher, so does the value of the Canadian dollar. On the other hand, if oil markets fall apart, this market will probably fall in the same manner.

Keep in mind though that the Swiss National Bank has been working against the value of the Swiss franc, so therefore it isn’t exactly one of the favored currency by traders around the world. However, right now it appears that oil markets are certainly too much of an anchor around the neck for the Canadian dollar to take off to the upside at the moment. In short, I believe that this market could very well bounce, and then offer yet another selling opportunity.