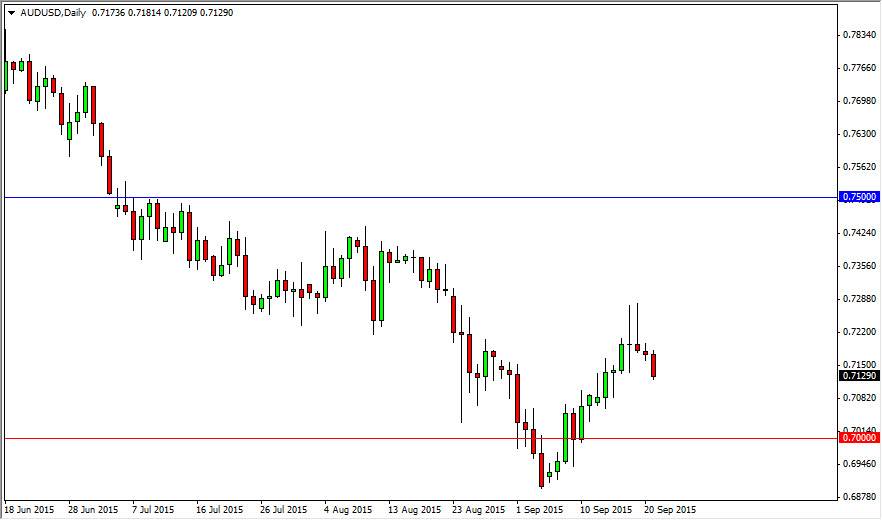

The AUD/USD pair fell significantly during the session on Monday, but most importantly broke the bottom of the shooting star from Friday. This of course is a very negative sign, as the Australian dollar looks to continue its downtrend that it’s been in for some time now. With this, I believe it’s only a matter of time before the sellers take over every time we rally, and therefore we should see the 0.70 level targeted given enough time. A break down below there is probable as well, as we will more than likely reach towards the 0.6850 region again, which was the most recent low in this currency pair.

Looking forward, expect quite a bit of volatility but there is still a significant amount of downward pressure at this point in time. Ultimately, I believe that every time we rally you have to be looking for selling opportunities as the Australian dollar continues to be so negative and heavy.

Commodity currencies

Commodity currencies will continue to suffer in general, as the Federal Reserve has explicitly said that they are concerned about global markets in volatility. That is not a good thing for commodities in general, and of course the Australian dollar will suffer as a result. Ultimately, the market will continue to punish anything involving risk, which of course the Australian dollar does. Copper and the gold markets will have quite a bit of bearish pressure in them over the longer term, as we have seen for some time. With this, I believe that the Australian dollar could very easily make a fresh, new low. However, it’s not going to be easy as we are very “long in the tooth” when it comes to this downtrend. Ultimately, I have no interest in buying this pair until we break above the 0.75 level, something that doesn’t look very likely to happen anytime soon. That being said, I believe that any rally just simply represents “value” in the greenback.