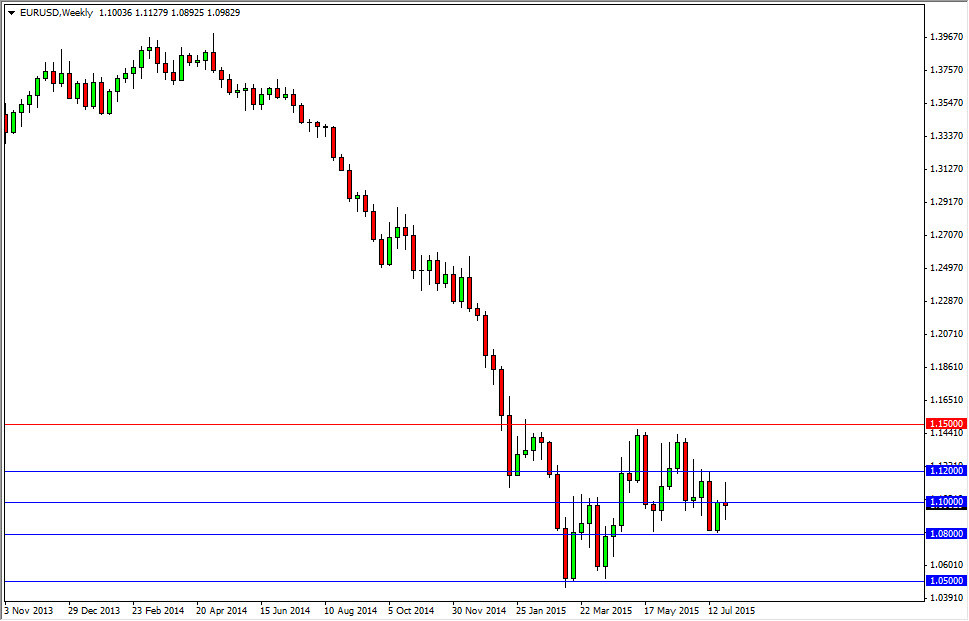

EUR/USD

The EUR/USD pair essentially went nowhere during the course of the week, as we continue to bounce around between the 1.08 level on the bottom, and the 1.12 level on the top. With this, I believe that the market continues to bounce around and very short-term type of moves in both directions, so quite frankly I am staying away from this pair in general.

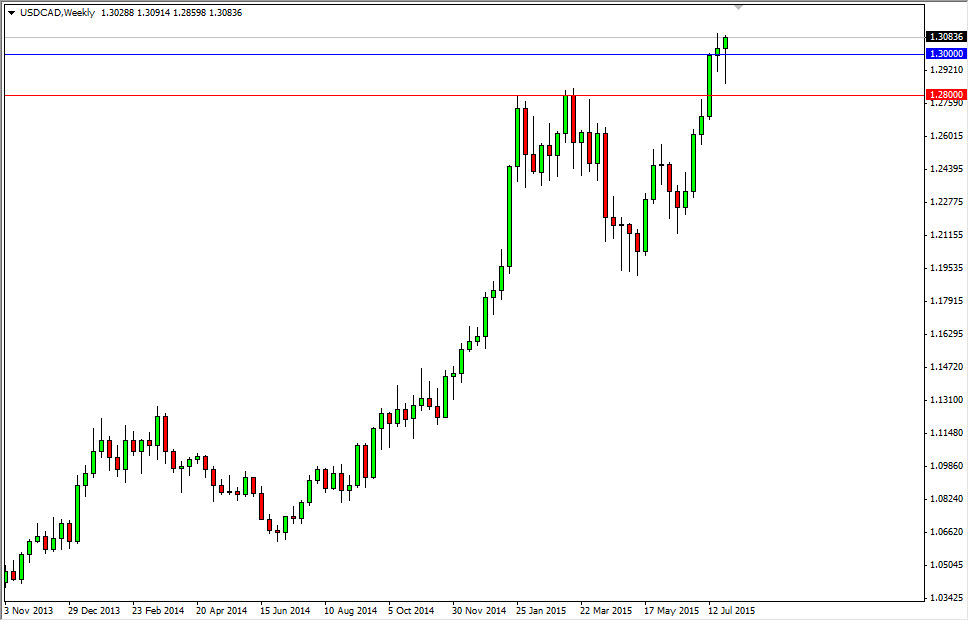

USD/CAD

The USD/CAD pair initially fell during the course of the week, but found more than enough support below at the 1.28 level to turn the market around. We ended up forming a hammer, and as a result it looks as if the market is ready to continue going higher given enough time, and perhaps head to the 1.35 handle. After all, breaking above the 1.30 level is a huge deal. That was where the market stalled during the financial crisis several times. Now that we are starting to get above there, this pair could really take out to the upside. Massive weakness in the oil markets certainly is in helping the Canadian dollar either.

NZD/USD

The NZD/USD pair initially tried to rally during the course of the week, but as you can see struggled at the 0.6750 level. With this, we turned back around to form a shooting star, at the bottom of a massive downtrend. If we can break down below the 0.65 handle, I think the market will continue to go much lower. Quite frankly, I believe that the 0.70 level is essentially a “ceiling” in this market at the moment. Ultimately, I believe that the New Zealand dollar will continue to struggle as commodity markets are falling apart in general.

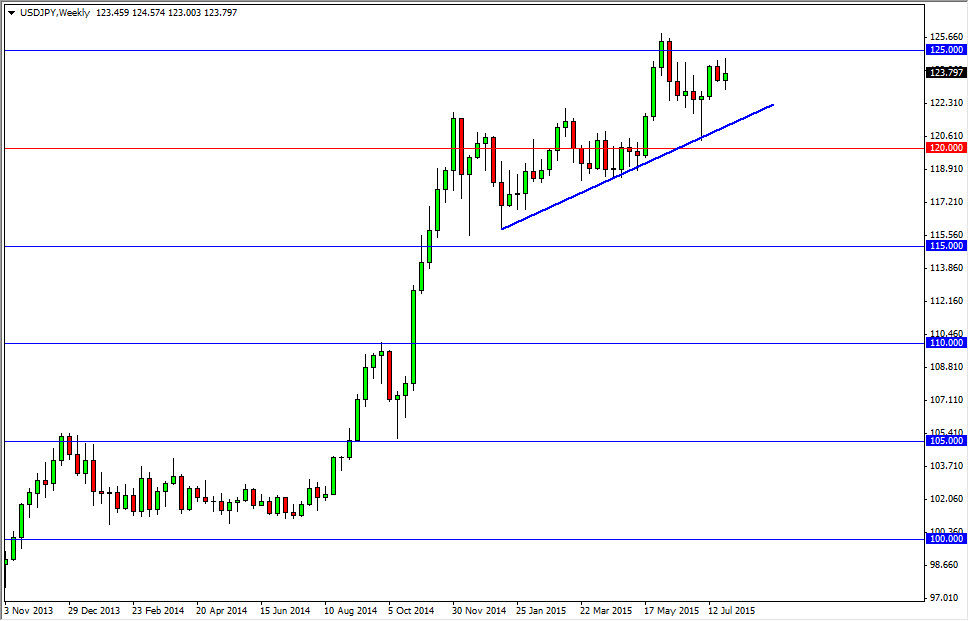

USD/JPY

The USD/JPY pair had a slightly positive candle form for the week, but at this moment in time we believe that the 125 level is a massive barrier that needs to be broken in order to go long. Once we get above there, the markets should continue to take out to the upside. As you can see though, there is an uptrend line just below, and as long as that remains solid, we should see this market gradually climb over the longer term. I have no interest in selling this pair at all.