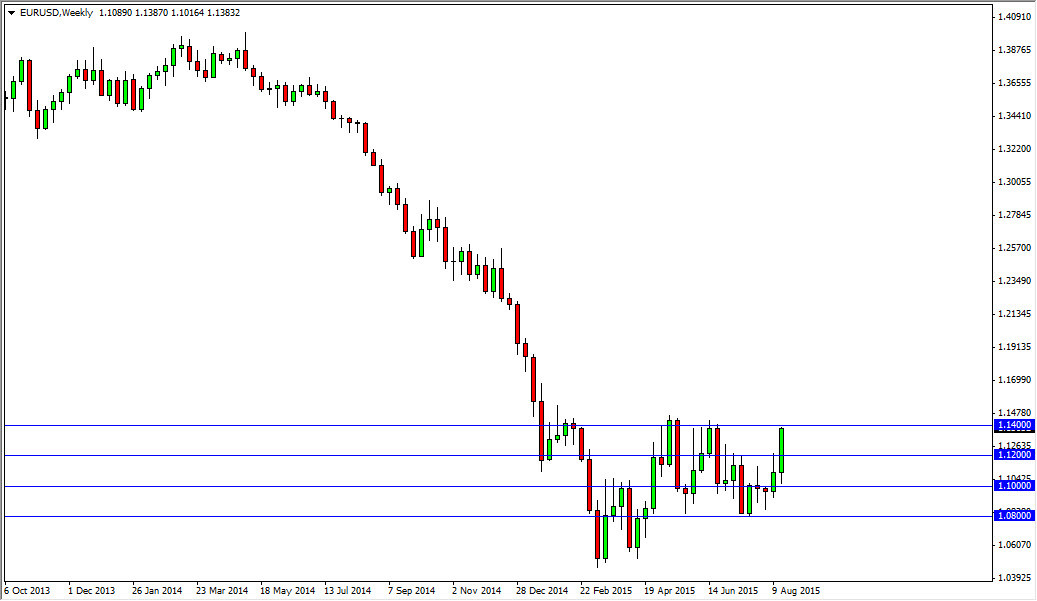

EUR/USD

The EUR/USD pair initially fell during the course of the week but found enough support at the 1.10 level to turn things back around and slammed into the 1.14 handle. At this point in time, this market does look like it’s probably a little bit overextended, so we are more than likely going to see selling opportunities. However, if we break above the 1.15 level, I feel that we have changed trends, and you would have to be a buyer at that point in time.

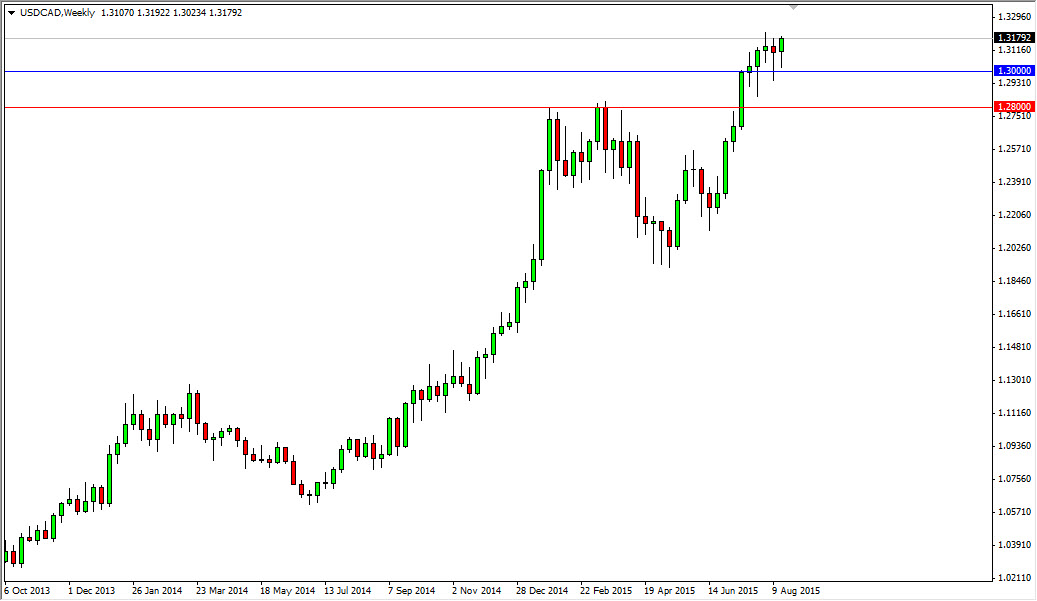

USD/CAD

The USD/CAD pair initially fell during the course of the week, but found enough support during the course of the week to bounce off of the 1.30 level. By the time we got done, we formed a hammer, and I believe this simply shows that you have to buy this pair every time it pulls back. We will eventually break above the 1.32 handle, and then head towards the 1.35 level. I don’t know if it’s this week, but I am certainly not selling.

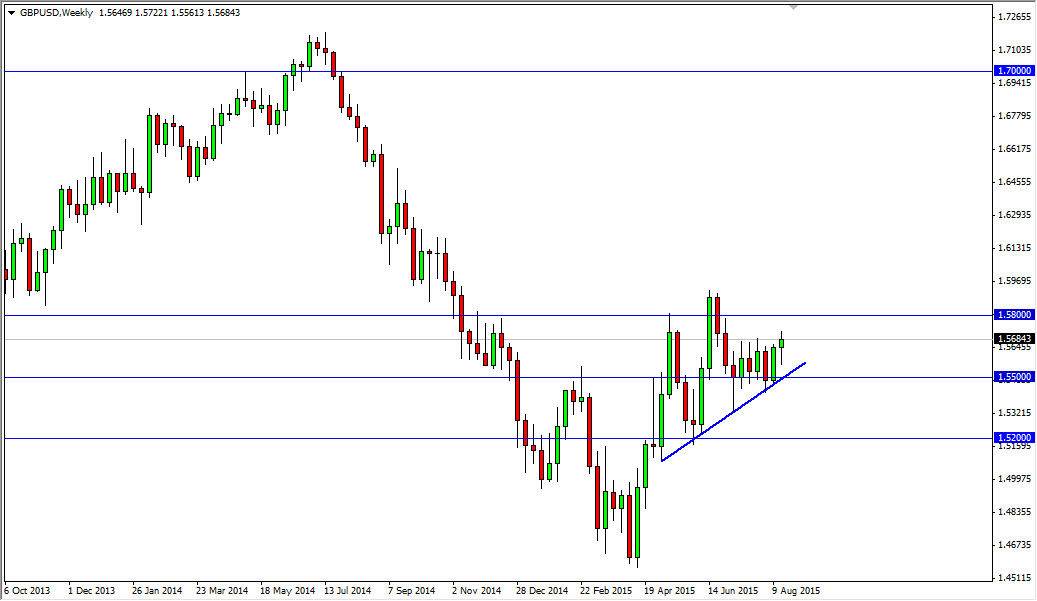

GBP/USD

The GBP/USD pair fell initially during the course the week but bounced enough to turn things back around and form a hammer. With that, the market looks as if it is ready to go higher. We could head to the 1.58 level, which has been resistance in the past. On top of that, we have an uptrend line just below and of course the 1.55 level to push this market higher. So at this point in time I feel that every time this market drops, you have to be thinking about going long.

USD/JPY

The USD/JPY pair fell rather significantly during the course of the week, especially on Thursday and Friday. However, we are sitting just above a nice uptrend line that I think will continue to bring in buyers. Regardless, I would have no interest in selling this pair until we break well below the 120 level, something that doesn’t look likely at this point in time.