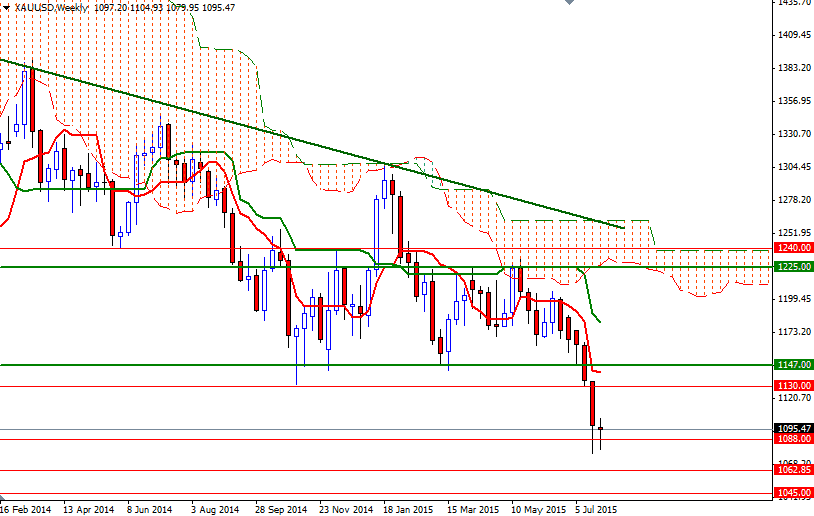

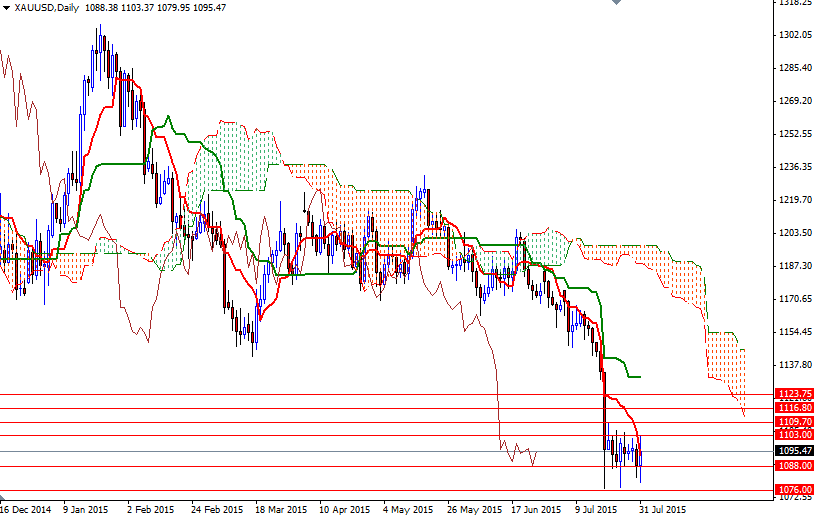

Gold prices ended the month down roughly 6.7% at approximately $1095 an ounce, weighed by speculations that the U.S. Federal Reserve adopts a gradual pace of tightening this year. The precious metal, which failed to perform throughout the Greek crisis, has been falling out of favor as market players move back into riskier assets. Good U.S. economic data along with the Fed's optimism about the health of the economy continued to push money into the dollar and equities and as a result the XAU/USD pair broke below the 1147/30 support and deepened its losses.

However, last week saw some consolidation due to physical demand which has picked up in response to the lowest prices in more than five-and-a-half-year. A deluge of key economic indicators will be released this week but it seems that the U.S. jobs report will likely set the tone for the American dollar for the rest of the month. If fresh data give the Fed more confidence that the economy is strong enough to endure higher interest rates, investment demand will likely weaken further.

The key support to the downside stands in the 1076/1 region and a sustained break below this support would suggest that the XAU/USD pair will has a tendency to fall all the way down to the 1045 level. Once below 1045, there will little to slow this pair down until we reach the next major support in the 1000 - 980 area. On the other hand, if the 1076/1 support remains intact watch a breakout above the 1109.70 which could foreshadow a move all the way up to 1130/23.75. Technically, the area between 1147 and 1130 should continue to offer resistance. In other words, it could be a suitable place to seek a bearish resumption after a possible pull back.