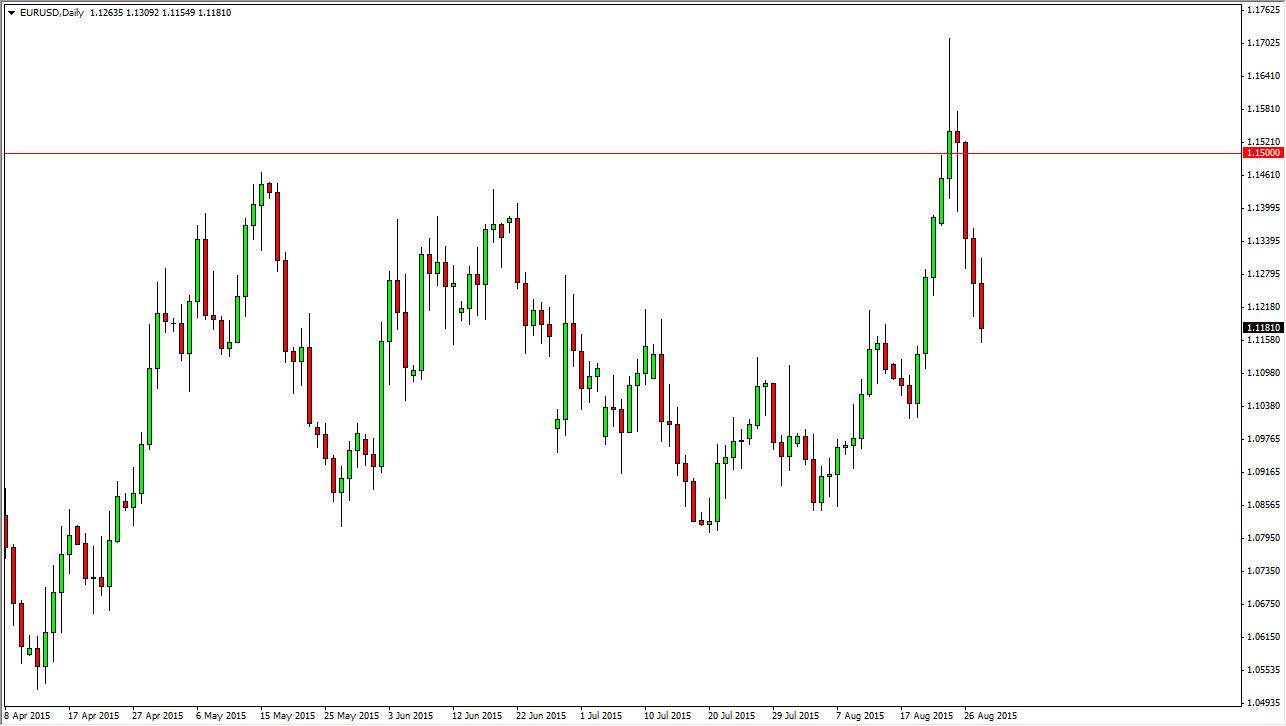

The EUR/USD pair fell again on Friday after initially trying to rally. Because of this, the market looks like it is essentially going to do a “round-trip when it comes to this pair. It’s only a matter of time before we break down again in my opinion, and this is especially true considering that we did manage to break down below the 1.12 handle. The fact that we fell so hard is a bit surprising to me, because quite frankly I figured a move above the 1.15 level would be the beginning of a significant trend change. However, the ferocity in which we turned back around shows me that there is still a lot of uncertainty when it comes to the Euro, and the financial markets in general.

Liquidity returns

Liquidity is returning to the marketplace, as it is the end of summer. Because of this, I think that we will see some “true moves”, and the fact that we could not hang onto the bullish move might be very telling. The beginning of the turnaround in this market signifies that something was wrong, but the fact that the US GDP numbers came out higher than anticipated suggests that the Federal Reserve might still be ready to raise interest rates, something that the market started to discount recently. Ultimately, I think this is just a symptom of a much more confused market in general, and with that I feel that it is only a matter of time before volatility throws the market back and forth, making it an almost impossible pair to trade with any type of confidence. I am waiting to see whether or not we get some type of impulsive candle in one direction or the other that looks convincing, but at this point in time I have no interest in risking money in a market that looks very dangerous.

I believe that the Euro will sell off again, at least for the short-term. However, I think it’s easier to sell the EUR/GBP pair or perhaps the EUR/CAD pair than this particular one just due to the fact that there so much noise just below.