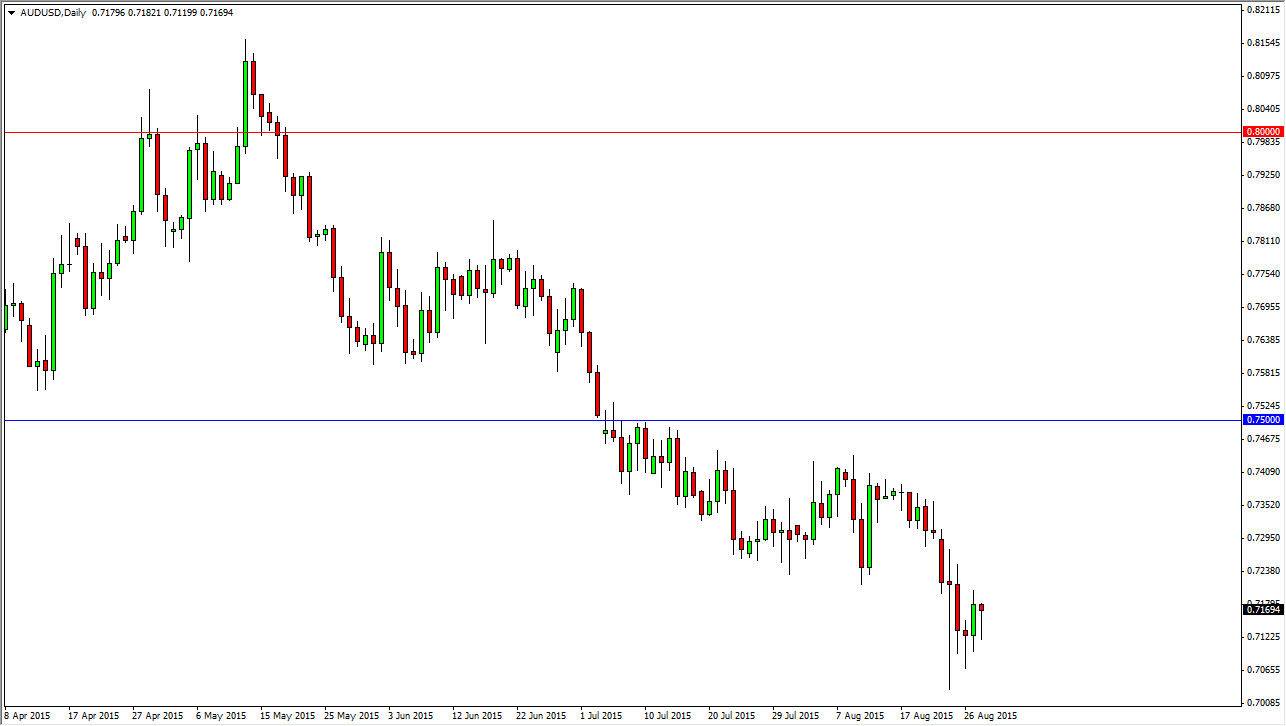

The AUD/USD pair fell initially during the course of the day on Friday, but found support just below the closing price in order to form a little bit of a hammer. This hammer suggests that perhaps we're going to get a bounce, but at the end of the day there is a lot of bearish pressure in general on this marketplace. I feel that this market will probably get a bit of a “relief rally”, as the market has been significantly sold off. On top of that, you have to keep in mind that the gold markets have found a little bit of strength, and that of course is going to move the Australian dollar drastically.

There is also the situation in China. We have seen quite a bit of quantitative easing, and that of course means that there could be more demand for commodities and construction projects. Australia provides a lot of the commodities for those construction projects, and as a result it makes sense that the demand for the Australian dollar will continue to increase, at least in theory.

Selling resistive candles

I still believe that the downtrend continues though, and that the loosening of Chinese monetary policy will only have a temporary effect on this pair. I think that it is not until we get above the 0.75 level that we can think about buying this pair with any real confidence, although I do recognize the short-term move is probably to the upside. I think that there is going to be much more likelihood in panic than elation, so having said that I think that it’s going to take just a little bit in the way of negative news in order to send this market heading much lower. The market will have to climb a massive “wall of worry”, so therefore it would take a lot of conviction to turn this marketplace back around. I don’t think we have it quite yet.