The USD/JPY pair fell significantly during the session on Wednesday, as fears reenter the marketplace due to the most recent headlines out of Athens. Quite frankly, the markets are getting a bit tired of the Greek debt situation so it’s very likely that any rush to safety will probably be short-term in life. After all, even the EUR/USD pair is finding buyers at this point.

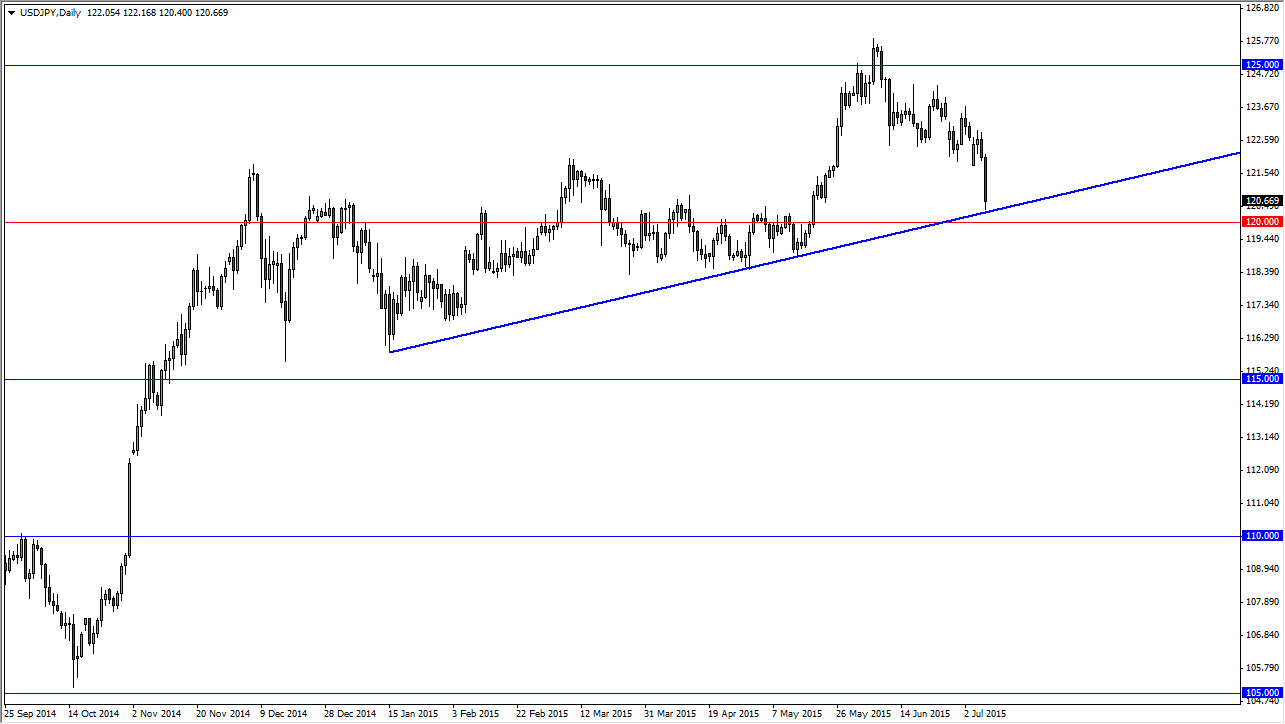

With that being said, I cannot help but notice on this chart that there is an uptrend line that we touched and bounced off of during the Wednesday session. Further compounding the case for buying is the 120 handle, which is the epicenter of a large cluster from March, April, and May in this market. After all, the longer-term trend is most certainly to the upside in the USD/JPY pair, and although the candle was very negative for the Wednesday session, I feel that it’s only a matter of time before we bounce.

I’m not selling

I’m simply not selling this pair. I can make an argument for massive support at the 120 handle, the 119 handle, and possibly even the 118 handle. And that’s after we get through the uptrend line. I believe that the industry differential will continue to favor the US dollar over the longer term, and this will be looked at as a potential buying opportunity that most of you will have wished you had taken months from now. I already have a long position in this market, and quite frankly look at this as an opportunity to add. I don’t have the right supportive candle quite yet, but quite frankly anything close to looking like a hammer, or possibly a bounce off of the trend line would be reason enough for me to add to my position. I think that the markets will aim for the 125 level by the end of the year, and probably even break above there and head towards the 130 handle. Quite frankly, if we can get the Greek issues behind us, this market should shoot straight to the upside.