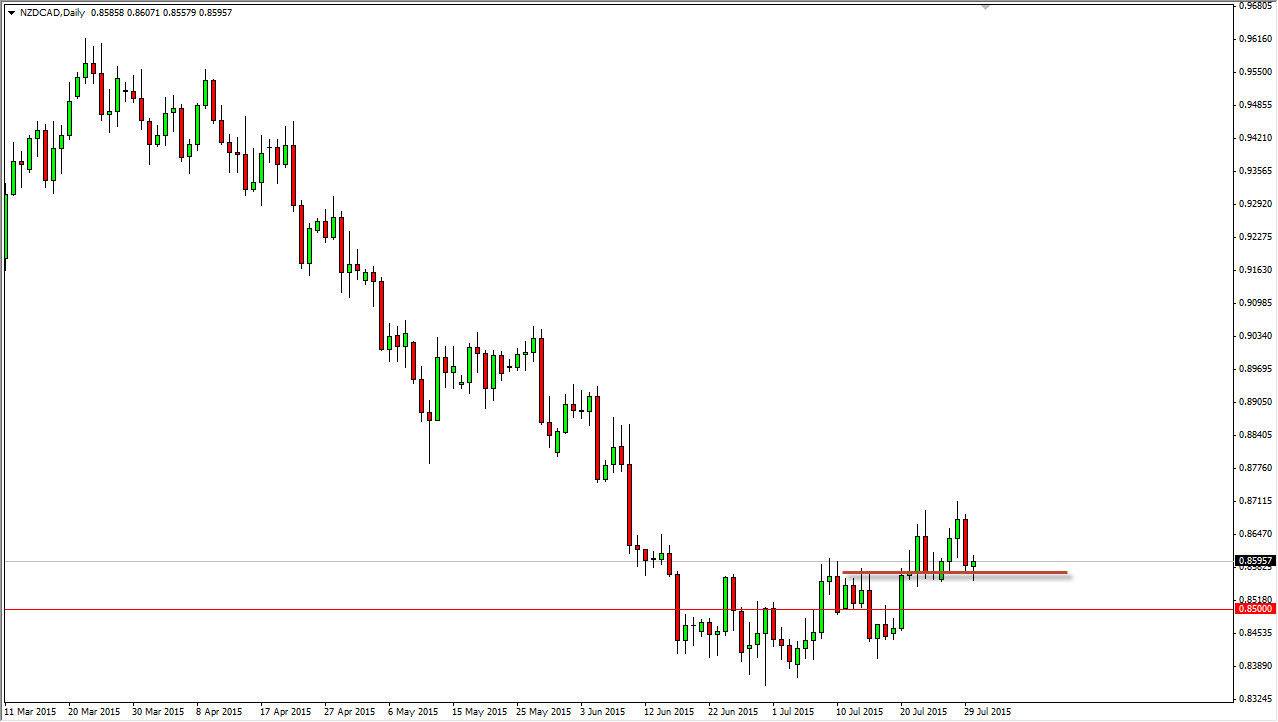

The NZD/CAD pair pulled back during the session on Thursday, but bounced enough to form a shooting star. It appears that we are pressing up against the 0.86 level, and the fact that we formed a hammer suggests that the market should go higher given enough time. Granted, this is pretty much a countertrend move, but you can make an argument for a much-needed bounce. On top of that, you have to keep in mind that the New Zealand dollar is doing a bit better than the Canadian dollar recently, and that should translate into this market as well.

Oil markets look actually horrible, and that of course is in a do anything for the value of the Canadian dollar in general. Because of this, I believe that we will continue to grind higher, but the key word of course is going to be grind. It’s likely to be an easy move, it is still countertrend until we get above the 0.90 level in my opinion, so while I don’t typically take countertrend moves, I think this is one of those rare exceptions that can be taken and done.

Commodities continue to suffer

Commodities will continue to suffer in general as well, and as a result I think that is what keeps this market from being explosive. On top of that, it is summertime and of course that means that there will be much in the way of liquidity. With that being the case, I feel that it’s only a matter time before the markets break out in one direction or the other, but it’s probably going to be a couple of weeks before we actually see that happen. Ultimately, I think that this market gives us an opportunity to play “small ball”, but the volatility should keep position size as low as well. In the meantime, it’s just far too choppy to risk a full sized position, but that can be said about a lot of pairs out there right now.