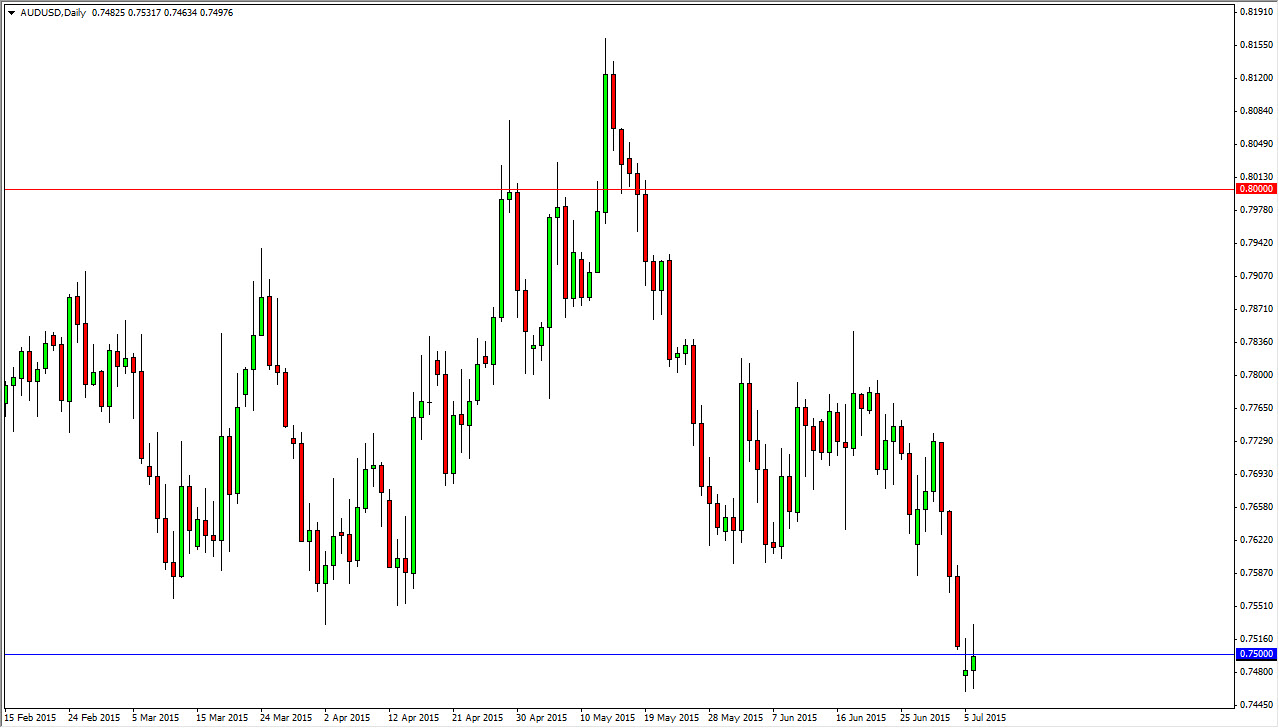

The AUD/USD pair gapped lower at the open on Monday, as the news of the Greek vote hit the wires. Because of this, riskier currencies got sold off, and with the Australian dollar being in such a nasty downtrend, it makes perfect sense that the market would continue to go lower. I believe that the attempt to fill the gap and the pullback that formed a shooting star like candle for the session suggests that we are going to see continued bearishness when it comes to the Australian dollar overall.

I believe that the 0.75 level is going to be important, and as a result if we can break down below the bottom of the range of the session the market should continue to go much lower, perhaps heading down to the 0.70 level. I think that the 0.70 level will of course be a large, round, psychologically significant number that the markets can focus on. On top of that, from a longer-term perspective, that level has been important in the past.

Sell rallies

I believe that every time you rally in this market, you can start selling. I believe that short-term charts might be the way to go, but quite frankly I think the longer-term trend is still very much in effect and it’s only a matter of time before we fall. I have no interest in buying the Australian dollar at all right now, because quite frankly the Asian will of course slow down demand for Australian commodities, and of course the gold markets have struggled to do anything recently as well. Typically, gold will be a driver of the Australian dollar and it isn’t driving anything at the moment.

It is not until we break above the 0.78 level that I would begin to think about buying this pair, and any rally that fails to hang onto gains between here and there is fair game as far as I’m concerned. Ultimately, this market remains in a very negative trend.