USD/JPY Signal Update

Yesterday’s signals may have been interpreted to take a long trade shortly after yesterday’s New York open, which would have been a losing trade.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, and then after 8am Tokyo time later.

Long Trade 1

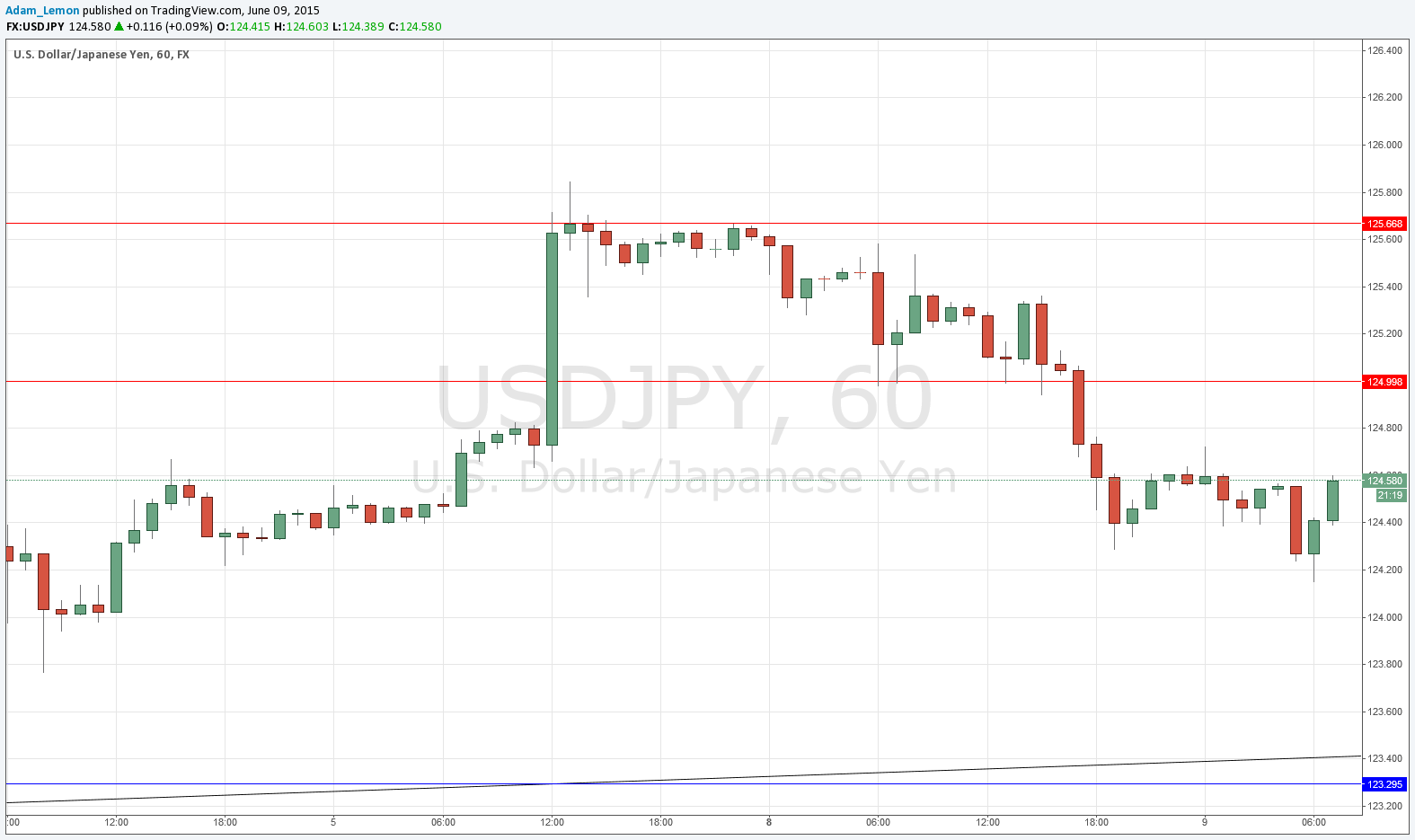

• Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line currently sitting at around 123.40.

• Put the stop loss 1 pip below the local swing low.

• Adjust the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

• Go short following a bearish price action reversal on the H4 time frame immediately upon the next touch of 125.00.

• Put the stop loss 1 pip above the local swing high.

• Adjust the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

• Go short following a bearish price action reversal on the H4 time frame immediately upon the next touch of 125.67.

• Put the stop loss 1 pip above the local swing high.

• Adjust the stop loss to break even once the trade is 20 pips in profit.

• Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

I had expected a break below the support at 125.00 would then see a move down to 124.66, but that we would then find support. We have actually moved lower, and things look short-term bearish. It would not be surprising if we continued to fall to around 124.00 or a little below that where there is a very broadly supportive area. However I see the real key buying opportunity lower still, at the bullish trend line which currently sits at about 123.40. This trend line has been around for a while (since the end of March) and could be expected to be very supportive. Above, the bearishness has quite probably flipped 125.00 from support to resistance now. If a near-term move up cannot break above that level, it would be a sign of a deeper pull-back beginning. I remain very bullish over the long-term, as does my colleague Christopher Lewis.

There are no high-impact events scheduled today for the USD or the JPY.