Gold prices ended higher on Wednesday as the dollar came under pressure after the Federal Reserve indicated that the forward path in interest rates is going to be slower than market expectations. In their projections, Federal Open Market Committee members said the economy is poised to grow between 1.8% and 2.0% this year, down from a March forecast of between 2.3% and 2.7%. While policymakers continued to predict that inflation might reach their 2% target in 2017, they lowered their median estimate for the federal funds rate at the end of 2016 to 1.625%, compared with 1.875% in March forecasts.

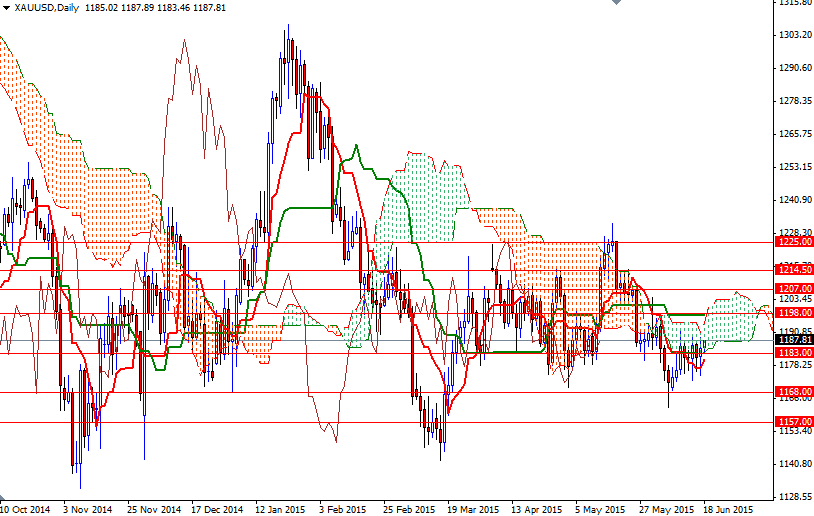

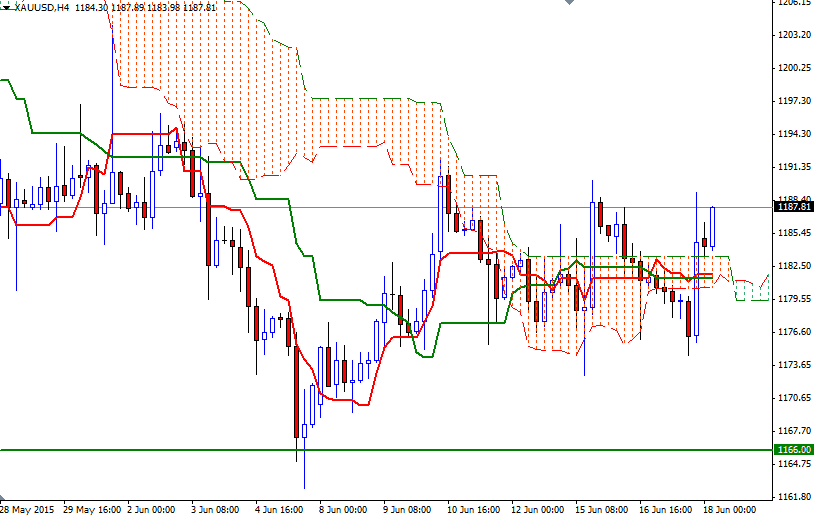

It appears that people were expecting a little more hawkish tone from the Fed on hiking rates, so yesterday's statement took some of the pressure off gold. Earlier in the Asian session, the XAU/USD pair pulled back to the 1183.46 level which happens to be the top of the Ichimoku could on the 4-hour chart but found enough support and turned higher. The short-term charts are slightly bullish at the moment, with the market trading above the Ichimoku clouds, plus we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines. However, the daily cloud still stands in our way.

The bulls will need to take out the resistance at 1192 if they want to have a chance to make an assault on the 1202 - 1198 region. Only a daily close beyond this barrier could provide buyers the extra fuel they need to tackle the next resistance at 1207. To the downside, support can be seen in the 1183.48 - 1180.50 area. If this support is broken, then we are likely to proceed to 1174 again. The next critical support below that level is located in the 1168/6 zone.