Gold advanced for the first time in four sessions as equity markets extended their losses and the dollar weakened. Last week, the XAU/USD pair had touched its lowest since March 19 at $1162.66 after the employment data fanned speculation that the Federal Reserve could raise interest rates this year. The Federal Open Market Committee meeting is scheduled to take place next week and in the meantime market players will be awaiting more U.S. data and monitoring the progress in Greece's bailout talks.

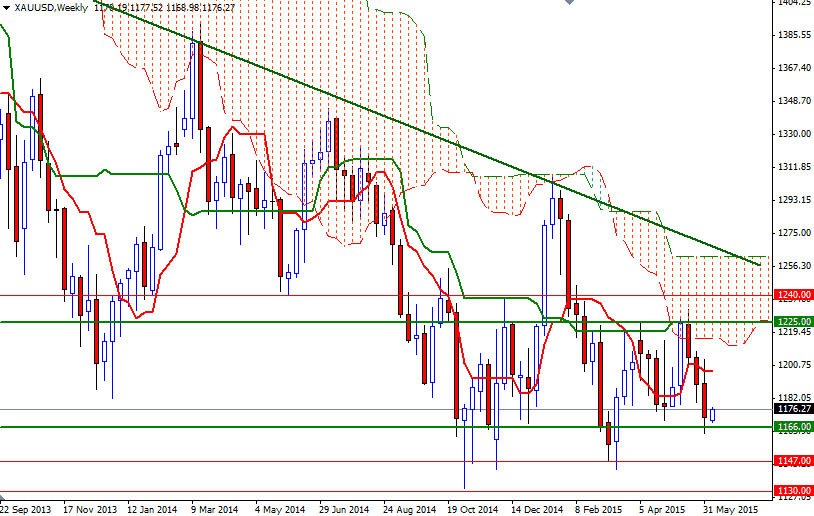

Trading below the Ichimoku clouds on the weekly, daily and 4-hour time frames suggest that the downside risks remain. Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines also weaken the technical outlook. However, as I mentioned in my previous analysis, it would not be surprising if we have made some kind of temporary floor above the 1168/6 area after three consecutive weeks of losses because it caused prices to reverse several times in the past.

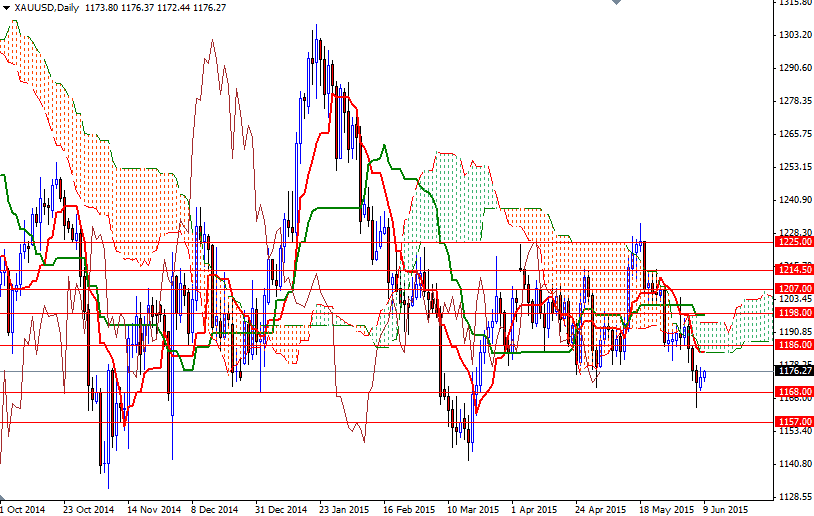

That said, I will keep an eye on the 1179.50 and 1171 levels. If the XAU/USD pair climbs and holds above 1179.50, it looks like prices will retrace towards the 1186/3 region where the bottom of the daily cloud and the Tenkan Sen line converge. Closing above 1186 on a daily basis would indicate that the bulls will be aiming for 1198/5 next. On the other hand, if the bears increase the downward pressure and 1171 gives way, then we will probably revisit the 1168/6 support. This area is the key for the bears to capture in order to challenge the bulls at the 1157 battle field.