EUR/USD Signal Update

Yesterday’s signals were not triggered as we didn’t start to fall off from 1.1276 until the London session had ended.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered before 5pm London time today.

Long Trade 1

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1200.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1276.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1450.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

We saw yet another strong move up yesterday following comments from the ECB. The move was driven more by EUR strength than USD weakness.

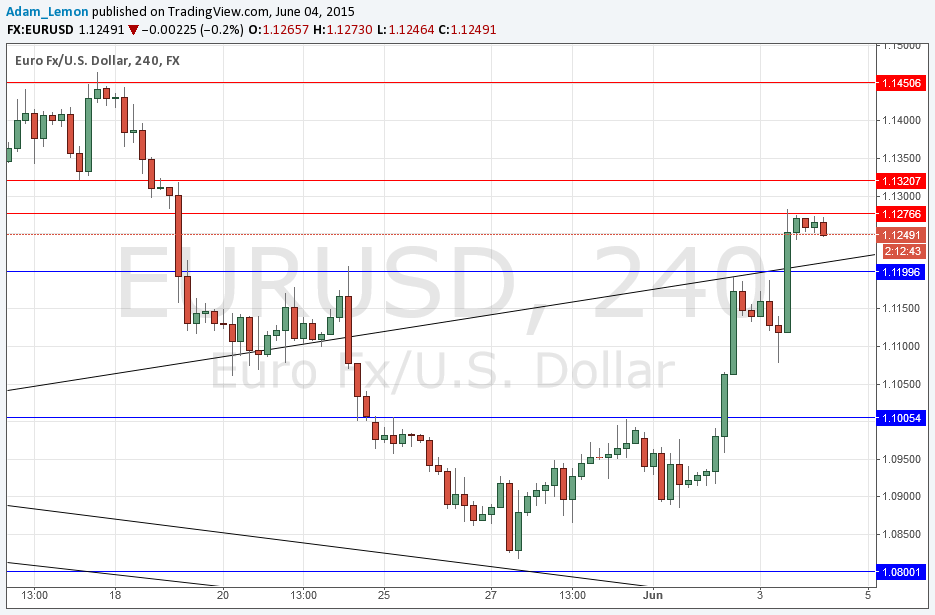

We blasted through the anticipated resistance at 1.1200 and that now looks to have flipped to probable support. A pull back to this level, especially if confluent with the old trend line shown in the chart below, could be a good long opportunity.

I forecast yesterday that 1.1276 would be likely to act as resistance and so far it did cap yesterday’s move. A quick trip up there followed by a convincing reversal pattern would be a logical place to enter a short trade.

If we can break up above the 1.1276 area, we could move further up quite quickly. There is resistance up there, but the key level is not until 1.1450, although there was also an inflection at 1.1320 so be careful of that.

There are no more high-impact events scheduled today for the EUR. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time.