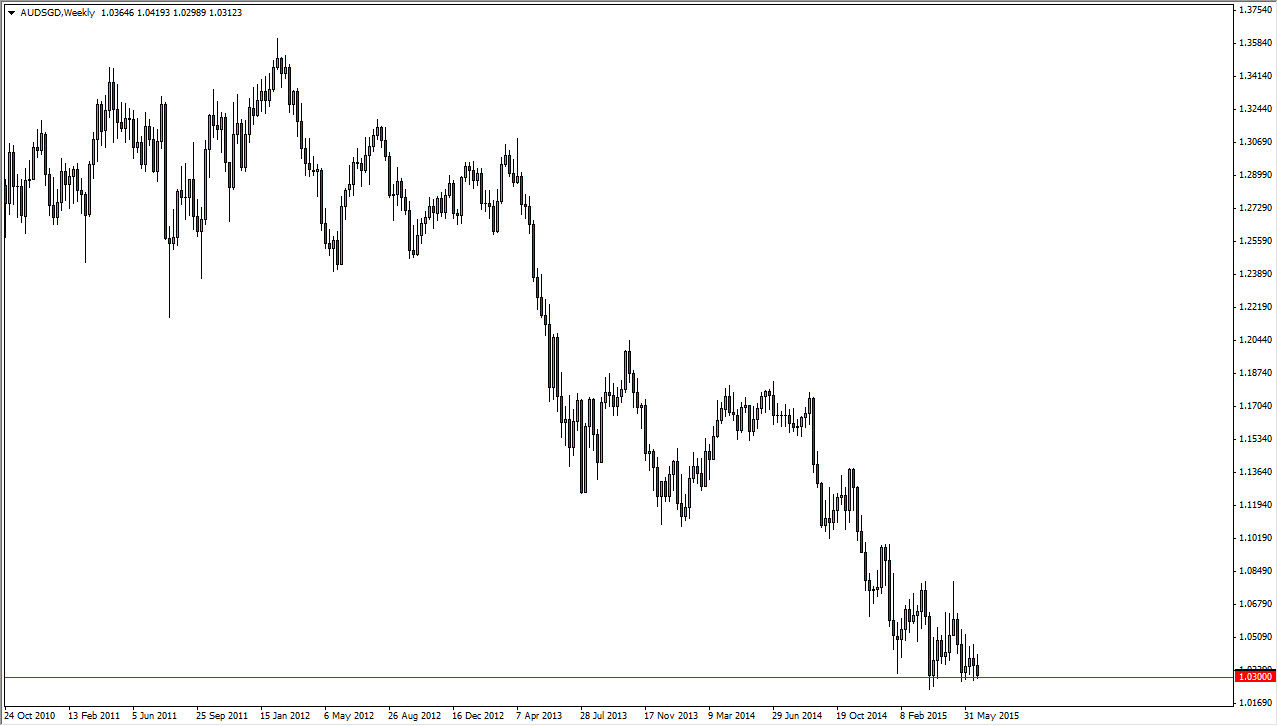

The Australian dollar mashed up against the Singapore dollar isn’t necessarily one of the most common pairs to play, but you’re going to have a hard time finding a market that is trending more in favor of a particular currency than this one. The Singapore dollar is considered to be a bit of a safety currency when it comes to Asia, and as the Australians are so heavily reliant on commodity markets, it makes sense that this pair continues to grind lower. However, the 1.03 level below is obviously massively supportive, and as a result I feel that if we can break below there for any real length of time, this could be a significant move, probably heading down to the parity level.

Any type of rally from here is a selling opportunity as far as I can see, going all the way to the 1.08 level. I think that rallies offer value in the Singapore dollar, as it is one of my more favored currencies. The Australian dollar is soft, and I think it’s only a matter of time before it really starts to fall apart. After all, the Australian dollar does tend to run parallel to the gold markets, and they are simply going nowhere at the moment.

Follow the trend

This really is as simple as following the trend. If you can keep your trades in one direction, it will save you a lot of heart ache. Simply being patient will be the way to go going forward, and letting the market come back to you at higher levels will be rewarding. Truthfully, I don’t really have a scenario in which I have an interest in buying this pair as it looks to be far too negative. However, I am also the first person to realize that waiting for huge moves probably doesn’t make sense, as we have sold off so drastically. Nonetheless though, the trend isn’t over.