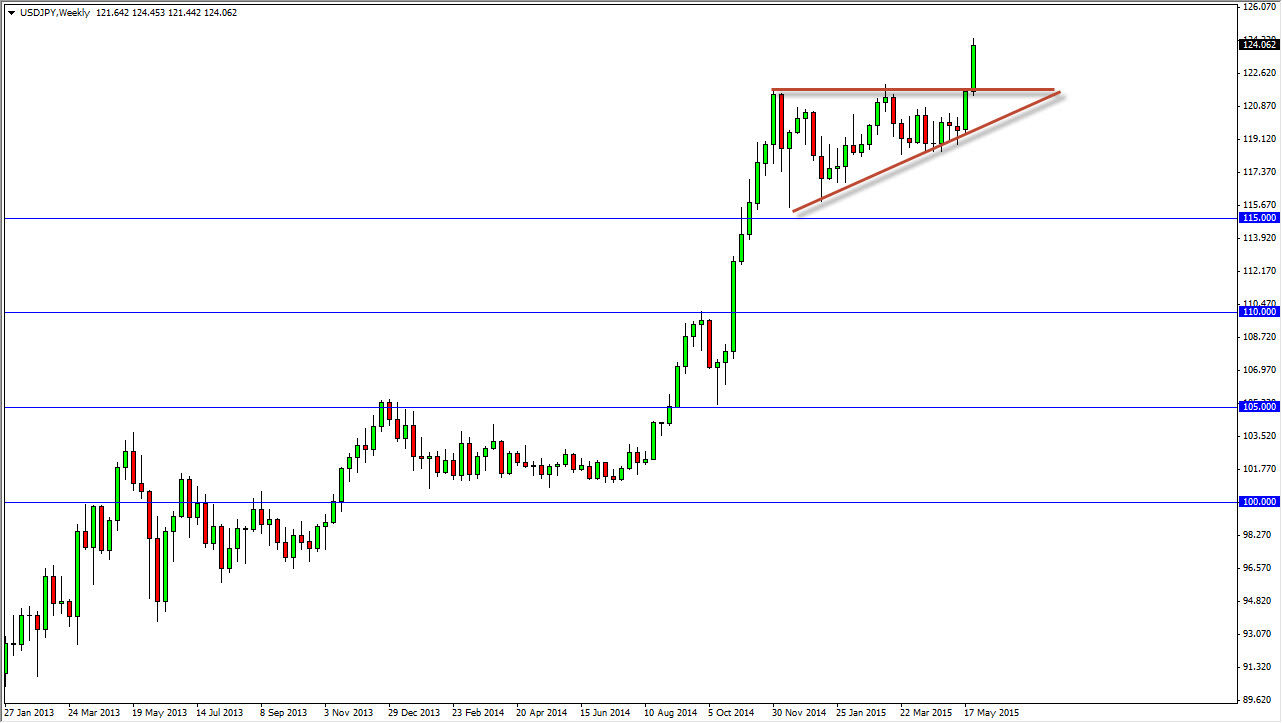

The USD/JPY pair broke out of a significant ascending triangle during the course of the last couple of weeks, so I think that the next leg higher is on tap. In fact, I believe that there’s no way to sell this market and that we should continue to see plenty of support near the 122 handle. I think that pullbacks are to be bought, and that by the time this month ends, we should continue to see bullish pressure as the interest-rate differential most certainly favor the United States anyway. With this, I am a buyer time and time again, and also am building a longer-term core position. I believe that ultimately this market goes above the 125 handle in towards the 130 handle given enough time.

Buying pullbacks

I believe that the “floor” in this market is somewhere near the 122 handle, but most certainly at the 120 handle we would see massive amounts of support. Obviously, a break down below there would be concerning, but I do not anticipate the trend actually changing until we sliced through the 150 level, something that I don’t things going to happen. In fact, I believe that we are in a multitier uptrend, and that it will continue for at least 2 more years, if not longer than that.

Ultimately, there is the occasional financial collapse that could affect this pair, but truthfully I think we are a couple years away from that right now. It appears that the market is comfortable with the Band-Aid approach at the moment, and that all of the reforms that have not happened significantly are still enough to keep the boom and bust cycle going. We are obviously in the beginning of a boom cycle as markets in general look very healthy. With that, you cannot fight the trend, and simply go on every time there is value in the US dollar. I firmly believe that the Bank of Japan will continue to keep the markets liquefied, thereby putting pressure on that Yen in general.