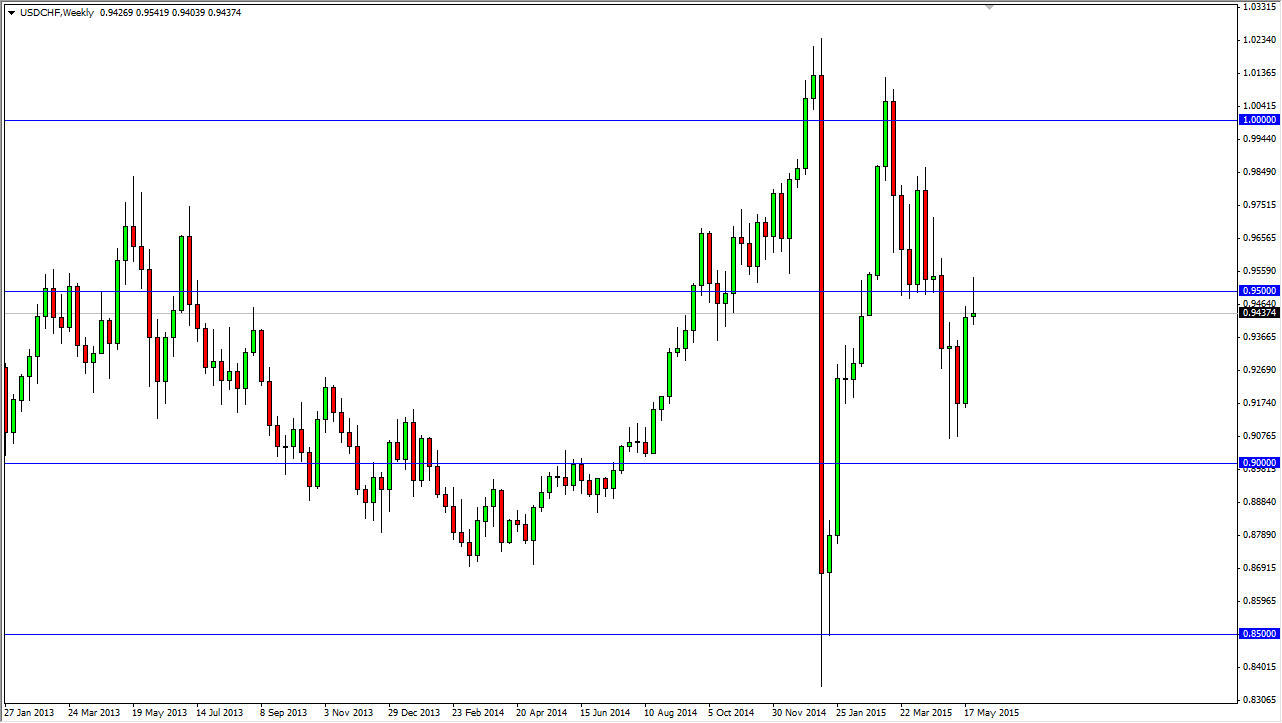

The USD/CHF pair rocketed all the way to the 0.95 handle during the course of the last couple of weeks, but started to see significant selling pressure at that area to form a shooting star on the weekly chart. That being said, the market looks as if it is going to continue to find pressure at the 0.95 handle, and the because of that I assume that the 0.95 level is the “equilibrium” of whether or not we buy or sell this particular market.

If we can get above the 0.95 handle, I am bullish as I believe that the US dollar will then head towards the 0.98 handle, and then eventually parity which would be the next large, round, psychologically significant number. I think that as long as we stay below there, the market will more than likely head back to the 0.91 handle, where it found support last time. Nonetheless, you can see that this is been a very choppy market, and I don’t see that changing anytime soon.

Ultimately, short-term trades will probably be the way

I believe that ultimately it’s probably be easier to trade short-term in this market than long-term, especially considering how choppy we’ve been over the longer-term charts. That of course suggests that the market really has no idea which way it wants to go for the longer term, and that of course is going to cause major problems. This of course is being greatly influenced by the EUR/USD pair, which of course is a complete mess as per usual.

Remember, the Swiss rely heavily on exports to the European Union, and as long as the European Union is having such a hard time, the Swiss of course will pay by proxy. However, there seems to be a bit of optimism entering the fray as far as the Europeans are concerned as a write this, but we are only one or two bad headlines away from seeing that momentum completely reverse again.