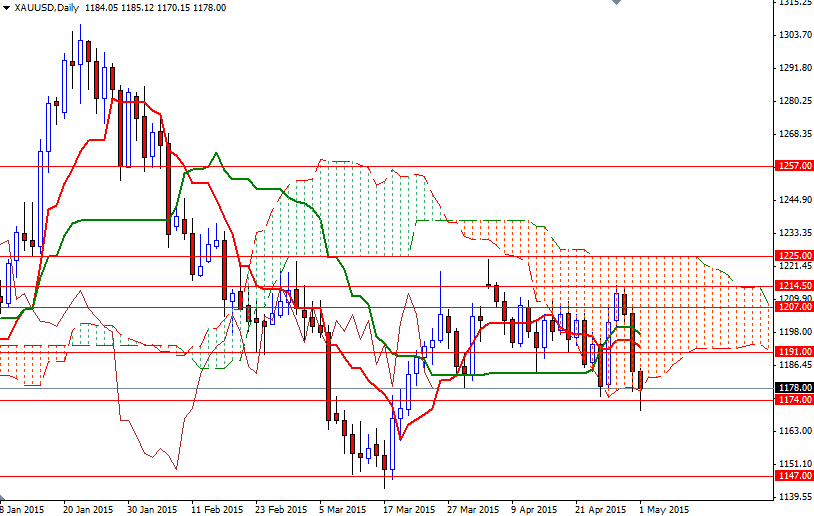

Gold fell to its lowest level in six weeks on Friday as the dollar strengthened and technical factors weighed on the market. Recent sluggish economic data has raised doubt over how quickly the Fed is going to start to raise rates to normalize policy but apparently Fed officials think it is too early to have a feel for second quarter growth. Although the XAU/USD pair hit its highest since April 7 at $1215.02 earlier in the week, the market found a certain amount of resistance in this area and reversed after the Federal Reserve signaled that it saw the recent slowdown in the economy as transitory.

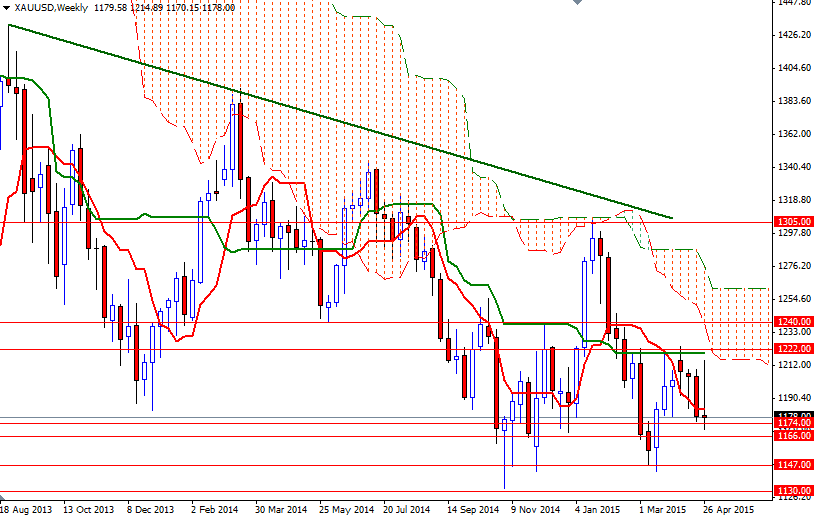

The Commodity Futures Trading Commission (CFTC) data for the week ending April 28 showed that net speculative positioning in gold barely changed during last month. From a technical perspective, there are two things I pay attention the most at the moment. Firstly, the bearish long-term outlook which has been in place since the market shattered the floor at 1532 back in April 2013. Secondly, persistent buying interest around the 1174 level. The tall upper shadow of the weekly candle indicates the bulls are struggling to hold on to gains as the weekly and daily Ichimoku clouds continue to act as strong barrier.

Negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines, along with Chikou Span/Price cross in the same direction, makes me think that the broader directional bias remains weighted to the downside. However, if the bears are planning an attack on the 1147 level, they will have to penetrate the supports at 1174 and 1166. In order to ease downward pressure, the bulls need to lift prices above the 1193/1 zone. If that is the case, I would expect XAU/USD to revisit the 1199/7 resistance. Only a daily close beyond this region could give the bulls another chance to reach the 1207 level.