AUD/USD Signal Update

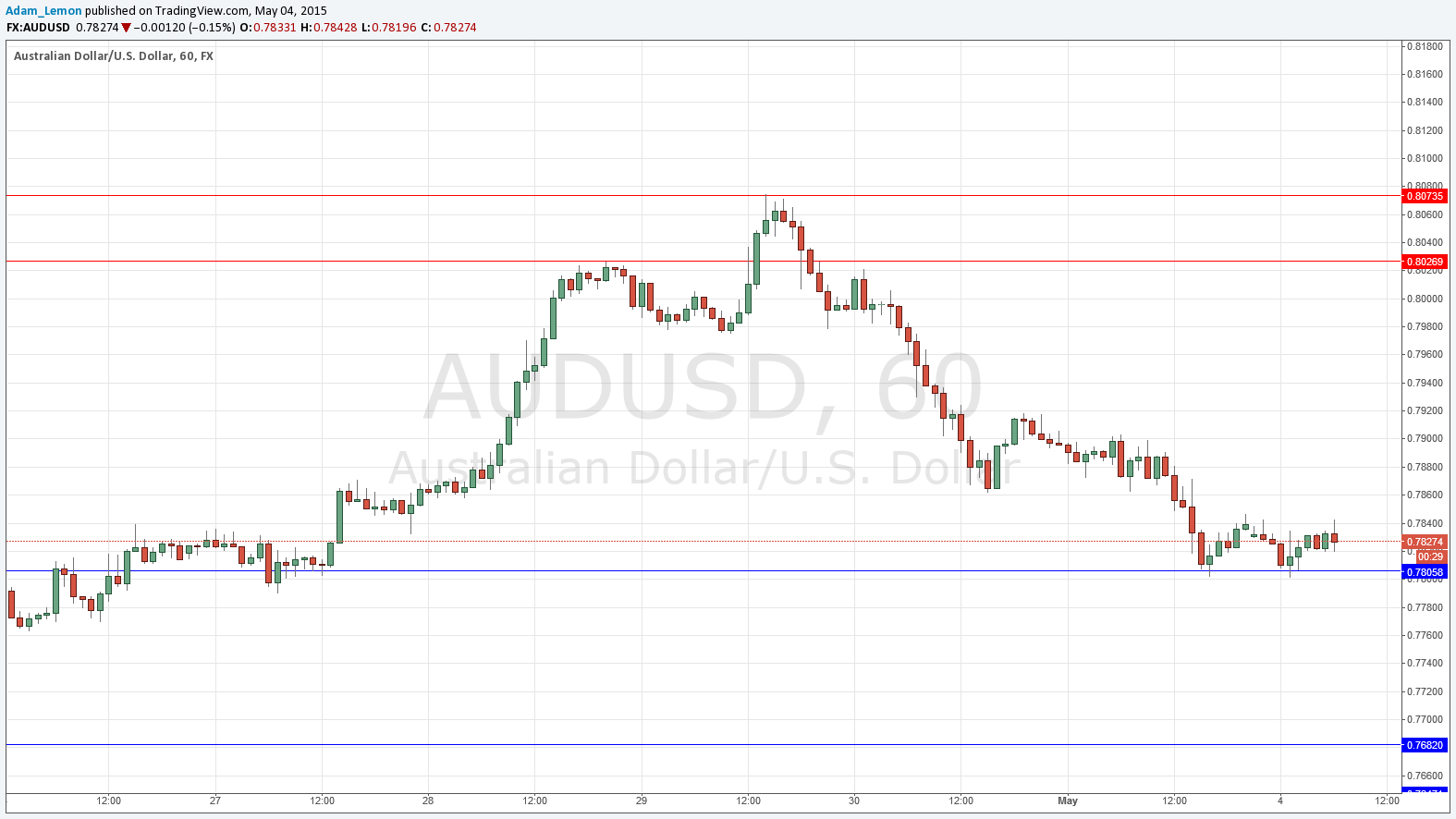

Last Wednesday’s signals were not triggered as the price closed above 0.8023 on the hourly chart before the price turned bearish.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken between 8am and 5pm New York time only, or after 8am Tokyo time later.

Long Trade 1

Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7806.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Go long following some bullish price action on the H1 time frame immediately upon the next touch of 0.7682.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short following bearish price action on the H1 time frame immediately upon the next entry into the zone between 0.8027 and 0.8073.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

The pair reached a significant new high price above the 0.8000 level shortly after my previous forecast, before falling sharply as the USD bounced back across the board. The price is now bubbling along just above key support at 0.7806 which may provide lift. However the significant move coming in this pair is not likely to really get going until the Australian session when there will be big news due concerning the AUD. There is some indication that the most probably surprise would be good for the AUD so it could be nice to already be long off 0.7806 when that news is released.

There are high-impact events scheduled during the next 24 hours concerning the AUD. There will be a release of Trade Balance data at 2:30am London time, followed later at 5:30am by the RBA Cash Rate and Rate Statement.