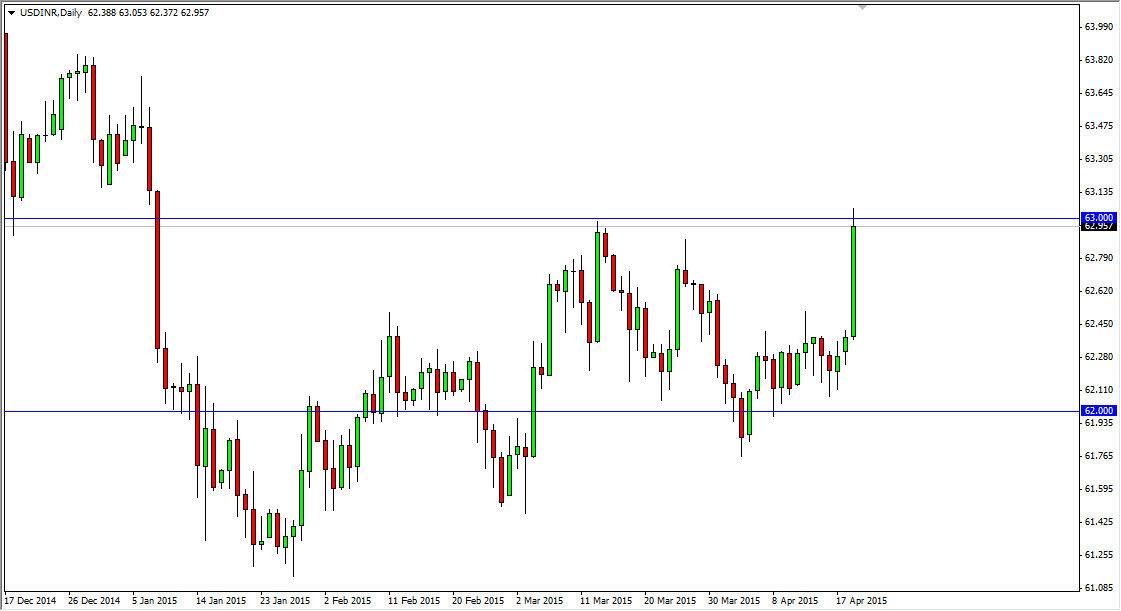

The USD/INR pair broke higher during the session on Monday as we crashed into the 63 level. This was the most recent high, and an area of significant support previously. The fact that we stopped at this level is not that big of a surprise, but quite frankly I believe that we are about to break out above it. After all, this is a very impulsive candle, and that normally means that you are going to see some type of continuation.

Quite often you will see some type of pullback though, so it’s not overly surprising to me that on the hourly chart at the time of writing, we did form a shooting star at this level. Quite frankly though, with the US dollar looking so strong around the world, I look at pullbacks as simple value presenting itself.

Buying pullbacks and breakouts

I believe that if we pullback from here, we will find supportive candles on shorter-term charts that allow me to buy the US dollar against the Indian Rupee. I also think that the pair represents the Third World, which people are not too keen on investing in at the moment. The US dollar of course represents the ability and the world’s reserve currency, so you can think of this is a risk appetite barometer. Right now it looks as if the market is settling on less risk appetite as the US dollar continues to climb in both the spot Forex market, and the US Dollar Index.

Currently there is talk of a retrospective tax on foreign investors, so perhaps money will run from the subcontinent. I believe ultimately the US dollar is going to be stronger anyway, so the reasoning behind the move higher doesn’t matter. Some people suggest perhaps it is simply a reaction to the possible Greek debt default, and people want to be in the US dollar overall. Again, I don’t think it matters, to me it does look like were going higher. On a pullback to show signs of support on the short-term chart, I am a buyer. On a break out above the top of the range for the day on Monday, I am also a buyer. I believe this market heads to the 64 handle next although I would anticipate some choppiness.