USD/CAD Signal Update

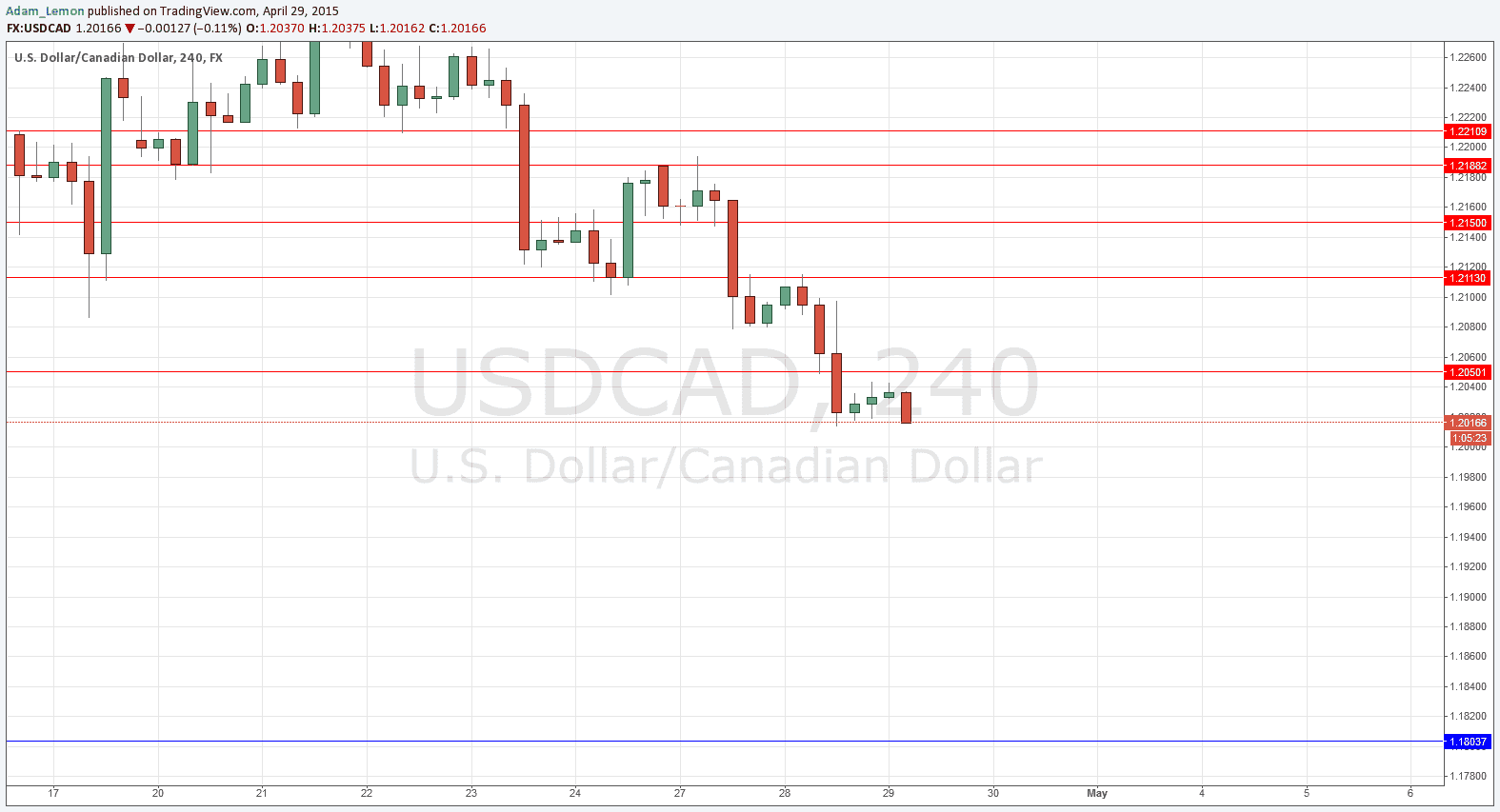

Yesterday’s signals were not triggered as although the price did reach 1.2050 there was no subsequent bullish price action on the H4 time frame.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be entered today between 8am London time and 5pm New York time.

Short Trade 1

Go short after bearish price action on the H1 time frame immediately following the next test of 1.2050.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

Go short after bearish price action on the H1 time frame immediately following the next test of 1.2113.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 3

Go short after bearish price action on the H1 time frame immediately following the next test of 1.2150.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 4

Go short after bearish price action on the H1 time frame immediately following the next entry into the zone between 1.2188 and 1.2210.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

Long entry after bullish price action on the H4 time frame immediately following the first test of 1.1804.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

The pair continued to fall yesterday in line with the continued retreat of the USD and the CAD has become one of the strongest currencies.

The support at 1.2050 gave a bounce up but it was short-lived and that level has now been flipped to likely resistance.

Although the whole number at 1.2000 may be psychologically important, there is no clear support below 1.1804 and therefore a USD-negative FOMC statement this evening just might cause a fall all the way down to that level, which could be a great opportunity for a good long trade.

There are several likely resistance levels above at which to get short after a pull back.

There are high-impact events scheduled today concerning the USD. There will be a release of Advance GDP data at 1:30pm London time, followed later at 7pm by the very important FOMC Statement and Federal Funds Rate announcement.