USD/CAD Signal Update

Last Monday’s signal gave a short off 1.2250 that provided a modest profit.

Today’s USD/CAD Signals

Risk 0.75% per trade.

Trades may only be entered today between 8am and 5pm New York time.

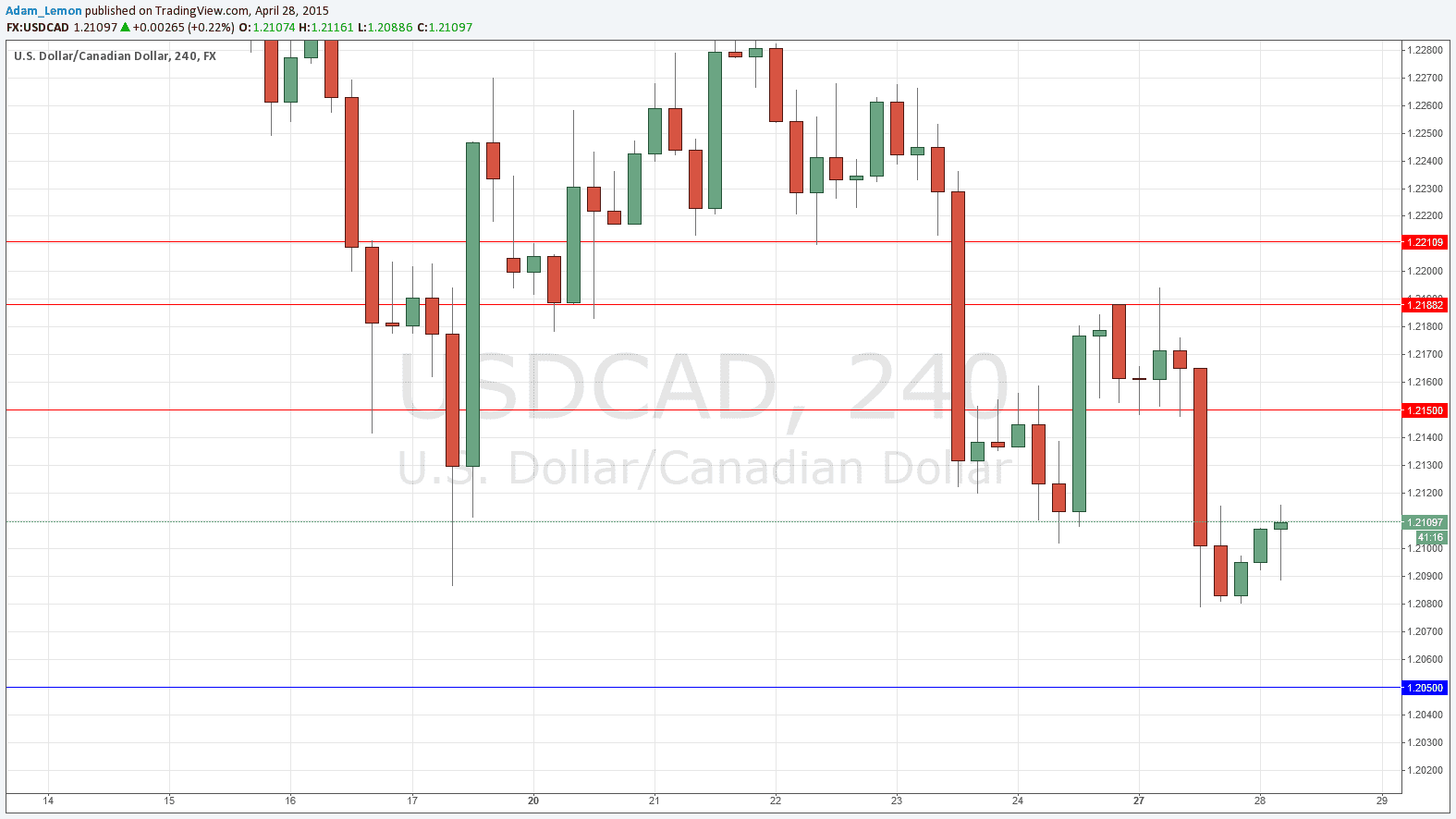

Short Trade 1

Short entry after bearish price action on the H4 time frame immediately following the next test of 1.2150.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

Short entry after bearish price action on the H4 time frame immediately following the first test of the area between 1.2188 and 1.2211.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Long entry after bullish price action on the H4 time frame immediately following the first test of 1.2050.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CAD Analysis

This pair has fallen sharply over the past week, printing little in the way of key support and resistance. In fact the CAD has become one of the primary movers of both the past 1 and 3 months. I foresaw the possibility of a sharp fall down to 1.2050 and this is what we have had, although we did not quite reach that level, although we may yet.

With the price now beginning to slow down, key levels are coming into focus. Tomorrow’s USD-related FOMC statement is going to prove crucial to this pair, although the strength in the CAD may remain due to the current recovery in the price of Crude Oil.

There are high-impact events scheduled today concerning the CAD but not the USD. At 1:45pm London time the Governor of the Bank of Canada will be testifying before Parliament.